When you start a nonprofit, one of the first things you have to worry about is obtaining your tax-exempt status. However, once you become a 501(c)(3) organization, it may feel like you’re constantly filling out different forms to maintain tax exemption and keep your nonprofit afloat.

Luckily, the W-9 for nonprofit organizations is a simple form to complete, allowing you to easily check another form off your to-do list. To streamline the process even further, we’ll answer the following questions:

- What Is a W-9 for Nonprofit Organizations?

- When Does My Nonprofit Have to Fill Out Form W-9?

- Why Is It So Important to Fill Out a W-9?

- How Do You Fill Out Form W-9 for Nonprofit Organizations?

- How Do You Submit Form W-9?

- What If I Need Help with Other Aspects of Nonprofit Financial Management?

Once you learn the ins and outs of Form W-9, you’ll be well-equipped to fill out the form, submit it, and move on to more mission-critical tasks.

What Is a W-9 for Nonprofit Organizations?

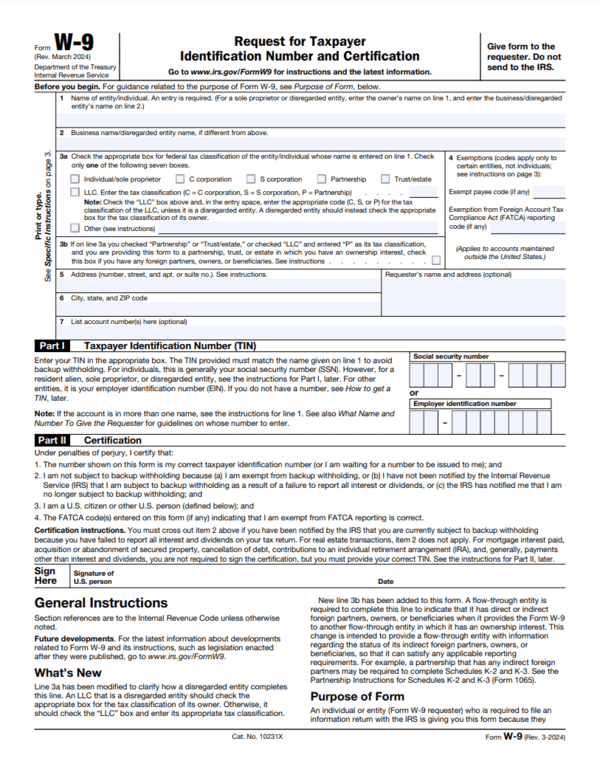

Form W-9, also known as the “Request for Taxpayer Identification Number and Certification,” is an IRS form used to collect the Tax Identification Number (TIN) for a contractor or business.

Additionally, this form also collects information like your nonprofit’s:

- Name

- Type of entity

- Mailing address

You can use the information you’ve collected from this form to file Form 1099, which reports on the miscellaneous income you pay to contractors, freelancers, and vendors.

When Does My Nonprofit Have to Fill Out Form W-9?

While this form isn’t exclusively for nonprofits, there are two possible instances in which your nonprofit would need to file Form W-9:

1. You work with a contractor.

When you hire an outside vendor or contractor and pay them more than $600 for their services, you need to request a W-9 from them. You’ll gain access to information like their TIN and mailing address so you can include this information (alongside the income you’ve paid them) on Form 1099.

For example, let’s say you hire a fractional CFO for part-time help with budgeting, grant management, and financial planning. If you’re working with this contractor for the first time, you should request a W-9 from them as soon as possible once your working relationship begins. That way, you can ensure you have all the information you need to properly report your transactions and avoid scrambling for these details when Form 1099 is due.

If you’ve already worked with this contractor before, you can continue using the original W-9 you requested from them. However, it’s good practice to periodically verify with your vendors and contractors that the information they’ve provided is still accurate. For example, if their address or TIN changes, you’ll need to request a new W-9.

2. You act as a contractor for another organization.

Although it’s less common, there may be some situations in which your nonprofit takes on the role of a contractor. For example, a well-established healthcare organization may provide paid consulting services to a newly founded healthcare nonprofit to get them up and running and pass on industry knowledge.

In this case, the new nonprofit would request a W-9 from the organization providing consulting services (ideally at the beginning of the working relationship), and the contracted organization would fill it out and promptly return it.

No matter which side of the contractual relationship your nonprofit is on, you should be familiar with filling out Form W-9 to expedite the process and ensure both parties have all the information they need.

Why Is It So Important to Fill Out a W-9?

While Form W-9 itself never reaches the IRS, it’s a stepping stone to accurate tax reporting. This form is necessary to prepare organizations to file Form 1099 and stay in compliance with IRS regulations.

If an organization fails to file Form 1099 correctly or on time (the deadline is January 31), they may receive penalties from the IRS, depending on how late the forms are filed.

If your organization won’t be able to file Form 1099 on time, you may be able to request an extension by submitting Form 8809 to the IRS. However, the IRS does not automatically grant extensions—which is why filling out Form W-9 and Form 1099 promptly is so important!

How Do You Fill Out Form W-9 for Nonprofit Organizations?

To get started with the W-9 process, locate the appropriate form on the IRS website. Then, follow these steps.

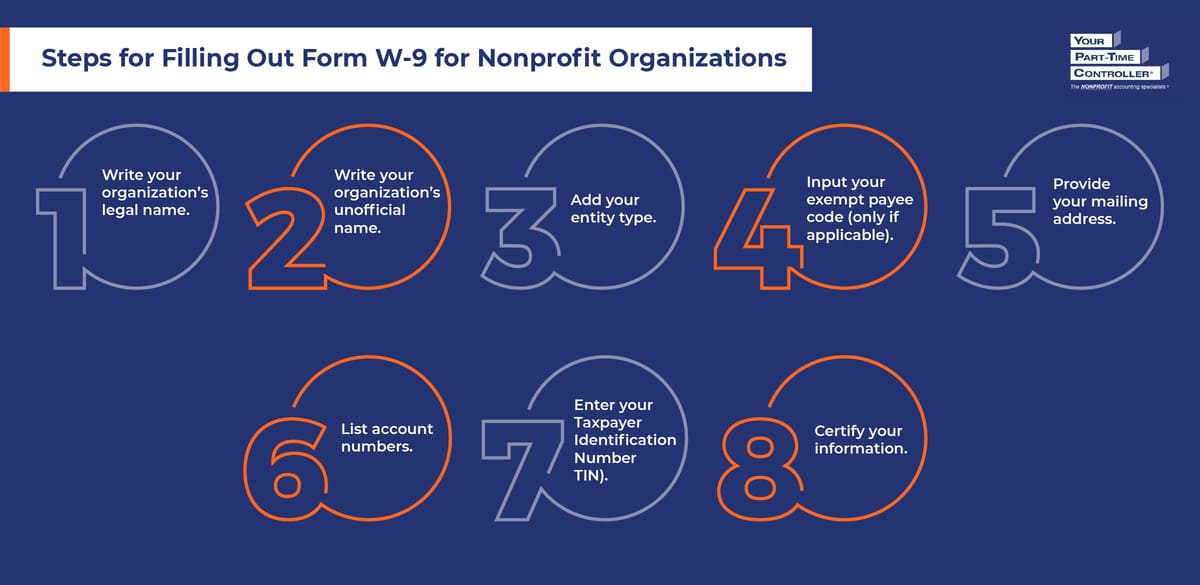

1. Write your organization’s legal name.

In Box 1, you’ll write your organization’s legal or official name. This should be the exact name you used on Form 1023 to become a tax-exempt organization and your articles of incorporation.

2. Write your organization’s unofficial name.

You may use an unofficial or assumed name to refer to your nonprofit that’s different from your organization’s legal name. If that’s the case, use Box 2 to enter your business name.

For example, your organization’s legal name may be “Save the Trees, Please Inc.” while your unofficial name would simply be “Save the Trees, Please.”

3. Add your entity type.

Box 3 is where you’ll include your federal tax classification or entity type. If your nonprofit is a corporation, you can check the “C Corporation” box. Alternatively, any nonprofit can check “Other” and mark their organization as a nonprofit, along with the type of tax exemption their organization holds, such as 501(c)(3).

4. Input your exempt payee code (only if applicable).

Most nonprofits will leave Box 4 blank, which lets people claim an exemption from backup withholding. The form’s instructions indicate which types of payments require you to input an exempt payee code, so make sure to double-check just in case.

5. Provide your mailing address.

In Box 5, you’ll provide your organization’s street number, street name, and apartment or suite number (if applicable). Then, in Box 6, you’ll complete your mailing address with your city, state, and ZIP code.

There is also a box next to these two boxes that gives you the option to enter the requester’s name and address. While optional, filling out this information allows you to keep track of the organizations that have access to your TIN, verify the entity or individual requesting the form, and ensure you can easily get in contact with them via mail if necessary.

6. List account numbers.

You may use Box 7 to list account numbers you’d like to share with the requesting entity or individual. This box is also optional, but if you’d like to share this information, it’s a secure way to do so.

7. Enter your Taxpayer Identification Number (TIN).

All registered 501(c)(3) organizations should have a unique employer identification number (EIN) issued by the IRS. Include this information in the section labeled “Part I,” and leave the Social Security box empty.

If you still have to apply for an EIN or are in the process of doing so, make sure to file Form SS-4 as soon as possible. Then, write “Applied For” in the TIN box. From this point, you’ll have 60 days to provide your EIN to the requesting organization.

8. Certify your information.

Lastly, you’ll sign and date the form in the “Part II” section to certify that:

- Your TIN is correctly stated.

- You are not subject to backup withholding.

- You are a U.S. citizen or other U.S. person.

- Any FATCA codes you’ve entered are correct.

Make sure to double-check that all the information you’ve included is correct so you can confidently sign and submit the form.

How Do You Submit Form W-9?

Determining your next steps for submitting Form W-9 depends on whether you’re requesting the form or receiving it from another entity:

- If a contractor requests the form from your organization, it’s your responsibility to fill out the W-9 and return it to the requester as soon as possible. Unless you have to apply for an EIN, it shouldn’t take you too long to fill out this form. Aim to get it back to the contractor within a week of their request.

- If your organization requests the form from another entity or individual, make sure it’s clear whether you’d like to receive the form via mail, email, fax, or an online document service. Once you get the form back, you’re all set to complete Form 1099 and return it to the contractor by the deadline.

Since these forms contain sensitive information, remember to keep them secure in your accounting system. This type of software will also help to keep all of your forms organized so you can easily access and reference them as needed.

What If I Need Help with Other Aspects of Nonprofit Financial Management?

Although the W-9 is simple and straightforward to complete, it’s essential that you take the time to ensure all the information you’re entering is accurate. Following the steps in this guide, you’ll do a thorough job and include everything you need.

If you require any other financial management assistance, the accounting specialists at YPTC are here to help. That way, you can reserve your time for more mission-critical work and be confident you’re managing your finances correctly. Contact us today to learn more about how we can tackle your organization’s accounting or bookkeeping needs.

If your nonprofit wants to learn more about nonprofit accounting and finances, check out these additional resources:

- Nonprofit Accounting: What Charitable Orgs Need to Know. Want to learn the ins and outs of nonprofit accounting? Look no further than this ultimate guide.

- What Is an In-Kind Donation? The Ultimate Nonprofit Guide. In-kind donations are contributions of goods or services instead of monetary donations. This article explores the benefits of in-kind donations and how your organization can record and report them.

- Demystifying Nonprofit Financial Statements: Complete Guide. Do you know the four main nonprofit financial statements your organization should compile? Dive into these important documents today.