As a nonprofit professional, your focus is on your mission. Whether your organization aims to end homelessness or food insecurity in your community, fund disaster relief efforts, find a cure to a certain disease, or further another essential cause, you put an immense amount of time, energy, and resources into making a difference.

However, to make your mission possible, you need to be able to finance your operations and activities. Nonprofit financial management may not be the first thing on your mind, but it’s a necessary part of making your organization run smoothly and fulfilling your nonprofit’s purpose.

In this guide, we’ll help get you up to speed on everything you need to know about nonprofit financial management by answering the following questions:

- What Is Nonprofit Financial Management?

- Who Is Responsible for Nonprofit Financial Management?

- What Policies Are Crucial for Nonprofit Financial Management?

- How Can My Nonprofit Develop an Effective Budget?

- What Are the Nonprofit Financial Statements My Organization Should Compile?

- How Else Can My Organization Practice Proper Nonprofit Financial Management?

Nonprofit financial management has many moving parts, and we’re here to help break them down for you. Follow along as we explore the ins and outs of managing your nonprofit’s finances so you can be confident in your organization’s ability to pursue its mission.

What Is Nonprofit Financial Management?

Nonprofit financial management refers to the policies and procedures that nonprofits use to manage their finances. While for-profit organizations aim to maximize profits and shareholder value, nonprofits have a different focus when it comes to financial management as they have a responsibility to serve their beneficiaries, use donors’ funds appropriately, and achieve their missions.

Nonprofit financial management involves planning, directing, and controlling your entity’s financial activities to ensure your organization can achieve its mission while maintaining financial health and compliance with relevant regulations.

Who Is Responsible for Nonprofit Financial Management?

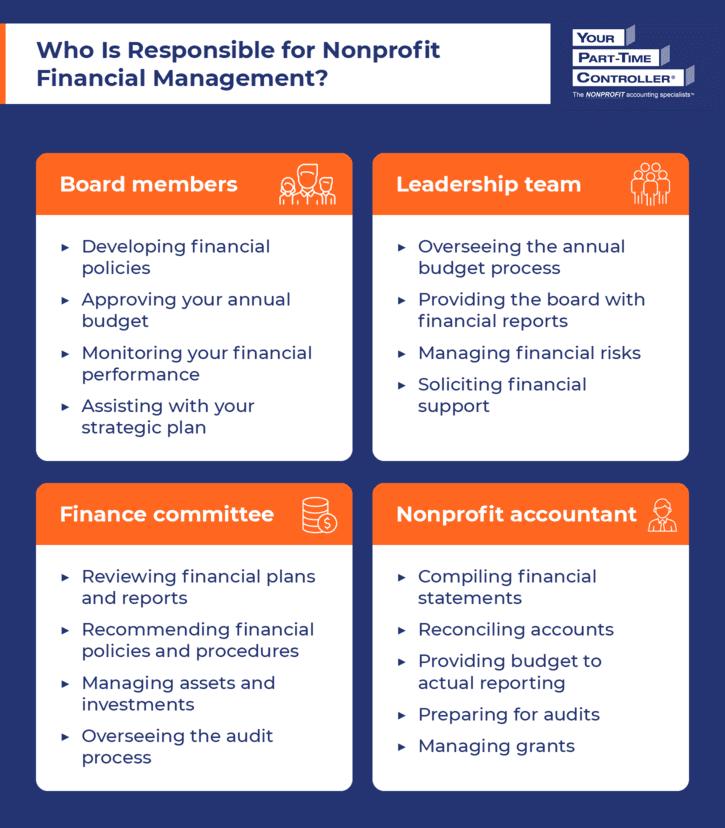

Financial management for nonprofit organizations is a team effort. Members from different areas of your organization must work together and rely on their unique expertise to properly manage your nonprofit’s finances.

The main stakeholders involved in nonprofit financial management are:

Board Members

As the governing body of your organization, your board provides strategic guidance for your nonprofit. One of their oversight areas includes financial management, ensuring your nonprofit complies with financial regulations and uses funds responsibly.

The board’s financial management responsibilities include:

- Developing financial policies. It’s up to the board to create (and update) the financial policies, procedures, and controls that will guide your organization’s use of funds. These documents provide guidelines for areas like budgeting, financial reporting, cash management, investing, and fundraising.

- Approving your annual budget. While your leadership team is in charge of determining your annual budget, board members have the final stamp of approval. They’ll review your proposed budget to make sure it aligns with your strategic priorities.

- Monitoring financial performance. Once your budget is locked in place, the board will assess your organization’s adherence to its budget and use key performance indicators (KPIs) to measure financial performance. These metrics may include donor retention rate, program services ratio, months of cash on hand, and fundraising efficiency ratios.

- Assisting with your strategic plan. Your board also helps provide the necessary financial context for your strategic plan by developing financial goals and identifying priorities, risks, and opportunities.

By providing higher-level strategic direction and financial insights, your board helps your organization make smart financial decisions that advance your goals and mission.

Leadership Team

Taking your board’s recommendations into account, your nonprofit’s leadership team is responsible for managing your organization’s financial operations on a day-to-day basis by:

- Overseeing the annual budgeting process. Members of leadership preside over the budgeting process, creating a budget that reflects your mission and allocates resources strategically.

- Providing the board with financial reports. Your leadership team ensures your board is fully informed about your nonprofit’s financial status. They give them financial reports and discuss fund stewardship with board members to make sure everyone’s on the same page.

- Managing financial risks. It is leadership’s responsibility to identify and mitigate any imminent financial risks. Thus, an important role of the leadership team is to oversee the creation and monitoring of financial policies and procedures.

- Soliciting financial support. Securing funds for your organization requires strong stakeholder relationships. Your leadership team fosters these relationships with donors, funders, and government agencies to ensure your nonprofit has adequate financial resources.

Since your leadership team is at the forefront of your organization’s overall strategy, they have the context needed to make financial decisions that align with your nonprofit’s priorities and push your mission forward.

Finance Committee

As their name suggests, the finance committee is narrowly focused on financial oversight, accountability, and transparency. Your finance committee typically includes board members with demonstrated financial expertise.

Members of your finance committee are responsible for:

- Reviewing financial plans and reports. Like your board and leadership team, your finance committee also has a hand in the budgeting process, reviewing the proposed budget to confirm it’s reasonable before approval. They’re also responsible for analyzing your organization’s financial reports and performance metrics to ensure your nonprofit is in a financially healthy and sustainable position.

- Recommending financial policies and procedures. Using their financial expertise, the finance committee helps the board develop policies that align with legal, regulatory, and accounting standards and regulations.

- Managing assets and investments. Your finance committee manages your organization’s assets, such as endowment funds or reserves, and creates investment policies to steward and grow those assets.

- Overseeing the audit process. To conduct a reliable audit process, the finance committee selects external auditors, reviews audit findings, and assesses audit recommendations.

Knowing you have an internal or outsourced group dedicated to financial oversight, you can feel confident in your nonprofit’s ability to make financial decisions backed by years of experience and expertise in this area.

Nonprofit Accountant

Like a for-profit accountant, a nonprofit accountant is responsible for planning, recording, and reporting your organization’s financial transactions. While their roles are similar, a nonprofit accountant often has additional responsibilities surrounding grant and donor management.

In this role, your accountant takes on the following responsibilities:

- Compiling financial statements. By compiling nonprofit financial statements, your accountant summarizes your financial performance and supplies data that other teams and stakeholders need to make well-informed decisions. (We’ll review these statements later on.)

- Reconciling accounts. To ensure all of your financial records are accurate, your nonprofit accountant will compare financial records from different sources (for instance, your accounting software and your bank statements) and make sure they match up. This way, you can be confident you’re basing decisions on correct financial information.

- Providing budget-to-actual reporting. Your accountant’s role in the budget process is translating the budget determined by leadership into a formal document that details your projected revenue and expenses as compared to your actual spending and fundraising numbers.

- Preparing for audits. While the finance committee is responsible for overseeing audits, your nonprofit accountant supports this process by preparing audit work papers and schedules, preparing financial reports, and gathering all important financial information for the auditor or tax accountant to file your organization’s Form 990 correctly.

- Managing grants. When you secure a grant, it’s important to efficiently record, report, and track these funds to ensure you’re using them responsibly. Nonprofit accountants can help with this process.

If you don’t have the resources to hire a full-time nonprofit accountant, outsourcing some of your finance functions to a firm like YPTC can be a successful solution. Outsourcing can help you supplement and support your entity’s finance functions for a fraction of the cost of a full-time accountant.

What Policies Are Crucial for Nonprofit Financial Management?

What Policies Are Crucial for Nonprofit Financial Management?

There are certain policies all nonprofits should develop to provide a foundation for proper nonprofit financial management. These policies include:

Gift Acceptance Policy

This type of policy outlines the rules for accepting gifts. It’s especially important to have a gift acceptance policy in place when you’re collecting in-kind donations so you can prevent donors from contributing items you can’t use, such as expired items, broken or damaged goods, items with legal restrictions, or hazardous materials.

To ensure it’s clear whether you’ll accept a donor’s gift before they contribute, your policy should cover:

- The types of gifts your organization can and cannot accept

- The circumstances or conditions under which you’ll accept different types of gifts

- The process of recording each type of gift

With this type of policy in place, you can give donors direction for what they can contribute. Plus, you can respectfully decline gifts that violate your guidelines by referring donors to your gift acceptance policy.

Conflict of Interest Policy

A conflict of interest policy helps nonprofits identify, manage, and mitigate potential conflicts of interest that could arise from key stakeholders’ outside financial interests or relationships. When you have a dedicated process for dealing with these conflicts, you can ensure everyone’s voice is heard while still protecting your organization’s integrity.

Your conflict of interest policy should define which types of situations involving your leadership team, board members, or other key stakeholders would be considered conflicts of interest. It should also cover how you’ll review, evaluate, record, and act upon potential conflicts of interest.

Ultimately, having a conflict of interest policy helps a nonprofit maintain trust and transparency with its stakeholders by mitigating any unfair influences on your nonprofit’s decision-making.

Expense Reimbursement Policy

This type of policy outlines how you’ll reimburse employees, volunteers, board members, or other stakeholders who incur work-related expenses on your organization’s behalf. It creates transparency surrounding your reimbursement process and promotes proper review and approval of expense reimbursements.

An expense reimbursement policy typically describes:

- The types of expenses that can be reimbursed

- The process for submitting reimbursement requests

- The documentation needed to support reimbursement requests

- The method and timeline for processing and issuing reimbursements

While it’s not ideal to have individuals incur expenses on your nonprofit’s behalf, it can be necessary to efficiently obtain resources and further initiatives. Uphold your relationships with these individuals by enacting a comprehensive expense reimbursement policy.

Fiscal Policies and Procedures

Nonprofit fiscal policies and procedures is an umbrella term for how your organization will conduct its financial operations. It’s typically a document you’ll revisit and update each year to make sure these standards align with your organization’s current internal processes and strategic decisions.

Your fiscal policies and procedures may cover areas such as:

- Internal controls

- Tax compliance and audits

- Budgeting and financial planning

- Financial reporting

- Cash management

- Expense management

- Revenue management

- Grant and contracts management

- Asset management

- Investment management

- Reserve fund management

- Risk management

When everyone is on the same page about how your financial operations should run, your team can execute their financial responsibilities more efficiently and effectively.

How Can My Nonprofit Develop an Effective Budget?

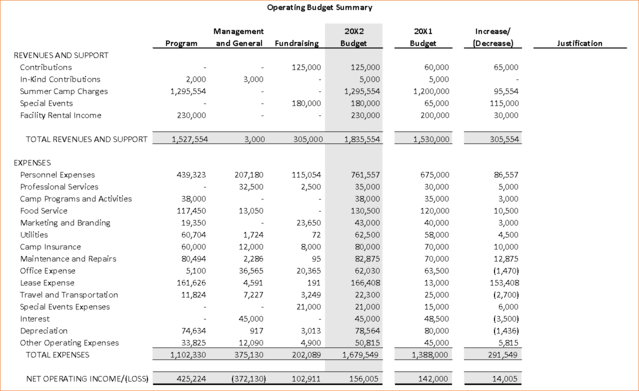

Your organization’s budget is the key to proper financial management. It provides a framework for managing revenue and expenses for the year so you can allocate resources effectively.

Your budget should include the activities you’re funding and realistic goals for revenue generation based on past financial performance, current data, and forecasts. The two main categories of your formal operating budget should be as follows:

- Revenues and support. This category represents the revenue you expect to generate throughout the year. These funds may come from donations, grants, membership dues, program fees, and other fundraising activities. In your operating budget, you’ll indicate whether these funds will come from program, management and general, or fundraising activities.

- Expenses. Your budget will also report on your projected expenses for the year, which may include program costs, management and general costs, and fundraising costs. Program costs represent expenses directly related to carrying out your mission, such as costs for programs, activities, and projects and the salaries of staff directly conducting or supervising program activities. Management and general costs are those associated with the overall administration and governance of your nonprofit, such as executive salaries, benefits administration, and payroll costs. Fundraising costs are expenses incurred to raise funds for the organization, including campaign expenses, event costs, and staff time dedicated to fundraising and development activities.

A comprehensive budget is integral to management’s ability to assess financial performance, monitor variances, and make informed business decisions. To keep your nonprofit on track, meet with your team to monitor budget performance on an ongoing basis. While you’ll meet each year to develop your budget, you should also meet quarterly to review your performance and monthly to catch and correct any mistakes.

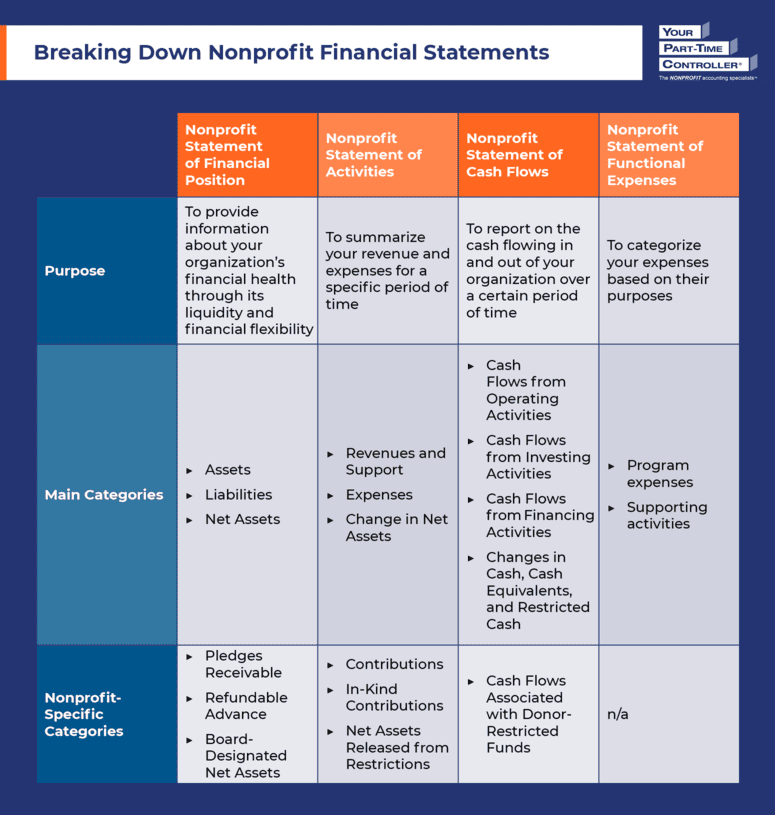

What Are the Nonprofit Financial Statements My Organization Should Compile?

As we explained in a previous section, your accountant is responsible for compiling a series of nonprofit financial statements. These documents summarize your organization’s financial activities and health to ensure you allocate resources effectively, make informed financial decisions, and stay accountable to stakeholders.

The four main nonprofit financial statements include the nonprofit Statement of Financial Position, nonprofit Statement of Activities, nonprofit Statement of Cash Flows, and nonprofit Statement of Functional Expenses. Let’s take a closer look at each of these documents.

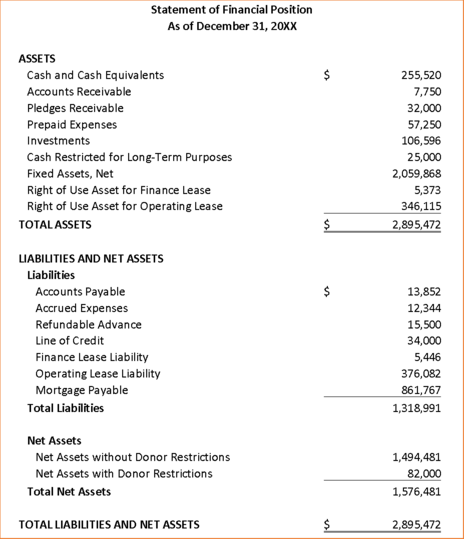

Nonprofit Statement of Financial Position

Those coming to the nonprofit world from a for-profit background may know the Statement of Financial Position as a balance sheet. Either way, this document reports on your organization’s financial health by summarizing its assets and liabilities. It provides information about your organization’s liquidity and financial flexibility as of a specific date.

This statement has three main categories:

- Assets. Your assets are the resources your organization owns. These may include current assets like cash and cash equivalents, accounts receivable, prepaid expenses, and inventory, or noncurrent assets like land, buildings, and equipment.

- Liabilities. Conversely, your liabilities are financial debts or obligations your organization owes to others. They may be current liabilities like accounts payable, accrued expenses, and deferred revenue, or noncurrent liabilities like mortgages and long-term lease obligations.

- Net Assets. Your net assets (or equity) are calculated by subtracting your liabilities from your assets, and they represent the financial resources available to your organization. If your net assets are positive, your nonprofit is in a healthy financial position, but if your net assets are negative, you may have to secure additional funds or cut costs.

Here’s an example of a nonprofit Statement of Financial Position:

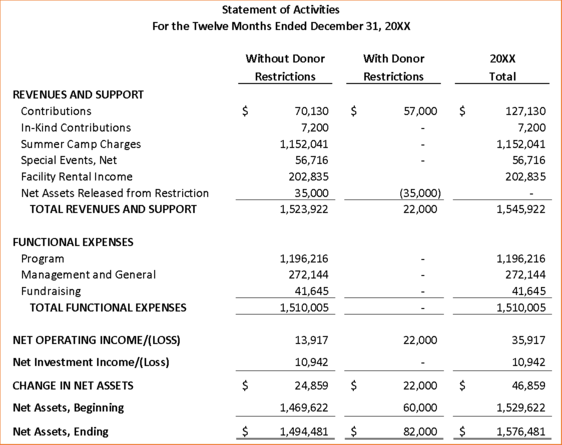

Nonprofit Statement of Activities

Also known as an income statement, the nonprofit Statement of Activities summarizes your revenues and expenses over a specific period of time, such as monthly, quarterly, or annually. This document provides insight into how you’re managing your resources for both your organization and its stakeholders.

The three main categories of this statement include:

- Revenues and Support. For a nonprofit, revenues and support can come from a variety of sources, such as amounts earned (like program fees) or amounts contributed. You’ll separate them by revenue type and further distinguish between contributions received with donor-imposed restrictions and those received without donor-imposed restrictions.

- Expenses. Your expenses are any costs your nonprofit incurs for program, management and general, or fundraising activities.

- Change in Net Assets. The difference between your revenues and expenses for the period is your change in net assets, which tells you how your financial resources have changed over time.

A very important feature of a nonprofit Statement of Activities is a separate line showing the reclassifications of net assets resulting from donor-imposed restrictions being satisfied. This indicates to financial statement users that donor wishes are being met.

Check out this example nonprofit Statement of Activities:

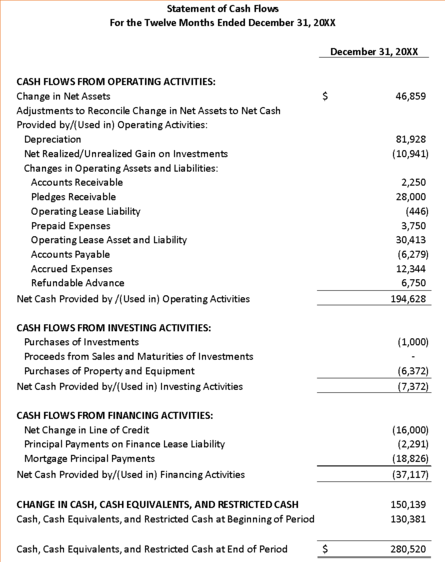

Nonprofit Statement of Cash Flows

The nonprofit Statement of Cash Flows is similar to the for-profit version of this document. It depicts the cash flowing in and of your organization at a specific point in time through the following categories:

- Cash Flows from Operating Activities. Operating activity cash flows represent the cash generated or used by a nonprofit’s core activities, such as providing services, receiving donations, and paying for operating expenses.

- Cash Flows From Investing Activities. In this category, cash flows represent the cash used or generated by the acquisition and disposal of long-term assets, such as property, equipment, or investments.

- Cash Flows from Financing Activities. Cash flows from financing activities represent the cash received from or used for activities related to borrowing and repaying debt. In a nonprofit, they may also include cash received with donor-imposed restrictions on their use, such as for an endowment or restricted for acquiring long-lived assets.

- Changes in Cash, Cash Equivalents, and Restricted Cash. Lastly, you’ll report your cash, cash equivalents, and restricted cash at the beginning and end of the period. This information will allow you to assess changes in your cash flow over time.

Your nonprofit Statement of Cash Flows will likely look something like this:

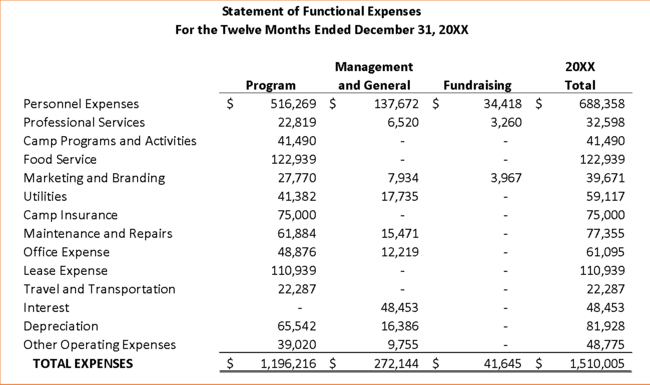

Nonprofit Statement of Functional Expenses

The final financial statement is the nonprofit Statement of Functional Expenses. This document reports your expenses based on their nature (type of payment made) and function (contribution to furthering your mission). While your nonprofit can also provide this information on the face of your Statement of Activities, most organizations choose to separate this analysis into a complete statement.

It’s important to indicate the nature and function of your expenses to express transparency about your resource allocations and properly report your expenses on your Form 990. In your Statement of Functional Expenses, you’ll indicate whether these expenses are part of your:

- Program expenses. Your program expenses encompass any costs related directly to your services. For instance, an animal shelter purchasing pet food would be incurring a program expense.

- Supporting activities. Everything else falls under supporting activities, which are further broken down into three additional categories:

- Management and general expenses, which relate to your nonprofit’s overall operations and management

- Fundraising expenses, which are associated with soliciting donations and securing grants

- Membership development expenses, which include any costs incurred in soliciting new members, collecting membership dues, and strengthening member relations

You’ll also have to list each expense by its natural classification, such as personnel costs, professional services, office expenses, occupancy, utilities, or depreciation. When you’ve completed the statement, the total expenses you’ve recorded should match the total expenses reported on your Statement of Activities.

Here’s an example of a nonprofit Statement of Functional Expenses:

How Else Can My Organization Practice Proper Nonprofit Financial Management?

If you’re looking for additional nonprofit financial management best practices, implement the following tips to keep your organization in a financially healthy position.

1. Tap into multiple revenue sources.

The more revenue sources your organization leverages, the more financially stable your organization will be. If you only rely on a few revenue streams, you risk the chance that they’ll fall through, leaving your nonprofit without the funding it needs to pursue its mission.

Put your nonprofit in a healthy position by taking advantage of a variety of different revenue sources, such as:

- Monetary donations

- In-kind donations

- Grants

- Corporate philanthropy

- Membership dues

- Investment returns

- Program fees

- Consulting fees

- Rental income

When you know you have resources flowing in from different sources, you can more effectively allocate your resources, plan ahead, and combat economic challenges.

2. Keep open communication about your finances with stakeholders.

In 2023, the one-year donor retention rate was 44%, meaning less than half of donors made a repeat donation at organizations they contributed to the previous year. To retain your donors and other stakeholders, you must show that you value their support and steward their funds appropriately.

Keep donors, funders, board members, and other stakeholders in the loop on how you’re allocating your resources by:

- Sharing your annual report. Your annual report summarizes all of your nonprofit’s activities and projects for the year. In your report, you’ll include your nonprofit financial statements, key financial performance metrics, funding and grant information, and impact and program outcomes. Increase transparency with your stakeholders by making this report publicly available on your website or sending it directly to them.

- Incorporating financial updates into your newsletter. Throughout the year, you can also add financial updates to your newsletter. That way, stakeholders can stay informed about your financial status on a regular basis.

- Using visuals. It’s often easier to digest financial information through visuals. Data visualizations allow you to convey complex financial data and trends in a way that stakeholders can understand at a glance.

Be open to questions about the financial information you’re sharing to further encourage an open dialogue around this topic. You may also solicit feedback on how you’re presenting financial data to understand how stakeholders prefer to receive this information.

3. Plan ahead for financial challenges or uncertainties.

Sometimes, you can’t prevent financial challenges or uncertainties from occurring. However, you can prepare for these issues ahead of time and ensure your organization remains stable.

In order to do so, your nonprofit should:

- Develop a financial contingency plan. Create a comprehensive backup plan for any financial challenges you may encounter. This may include identifying potential financial risks, developing contingency scenarios with associated response plans, and building an emergency fund.

- Analyze financial metrics. Keep track of your organization’s financial data to make sure you’re in a stable position. Calculate metrics such as your operating reserve ratio, liquidity ratio, and debt-to-equity ratio.

- Engage in strategic planning. A well-developed strategic plan helps your organization set and strive for long-term financial goals. Additionally, this process helps you forecast future financial needs and allocate your resources accordingly.

The key here is to be proactive. When you think about potential financial challenges ahead of time, you can be confident in your ability to respond to these issues and alleviate stress for your team.

4. Educate stakeholders on the necessity of overhead spending.

If you’ve been in the nonprofit sector for a while, you’re probably familiar with the overhead myth. Some organizations believe nonprofits must keep their overhead costs below a certain percentage. Estimates range anywhere from 15 to 35%.

However, there’s no magic number for overhead expenses. These costs are necessary to ensure your organization’s operations run smoothly, allowing you to build your capacity to pursue your mission. Every nonprofit has a different ideal amount they should allocate to overhead costs based on their organization’s age, size, geographic location, and specific needs.

Your stakeholders may be alarmed by the prospect of their contributions going to overhead instead of directly to your cause. It’s important to explain that without overhead costs, you wouldn’t have the infrastructure to achieve your goals and make a difference.

If stakeholders are still hesitant to contribute to overhead expenses, an overhead aversion study by behavioral economist Uri Gneezy recommends offering overhead-free donation opportunities to smaller donors. You can do so by partnering with major donors to cover these costs. Just remember to be transparent with all stakeholders about how you intend to use their funds.

5. Use the right software solutions.

While for-profit financial management focuses on maximizing profit, nonprofit financial management is all about using funds responsibly and staying accountable to stakeholders. Because of these differences and the unique nature of nonprofits, it’s helpful to use accounting software solutions specifically designed for charitable organizations.

Many accounting software providers, such as QuickBooks and NetSuite, offer nonprofit-specific options. Look for software that aligns with your budget, your organization’s financial needs, and your nonprofit’s size.

6. Prepare for audits.

Independent financial audits allow you to confirm that you’re following nonprofit financial management best practices by getting an outside perspective on your organization’s financial operations. While your current practices should stand for themselves, there are some steps you can take to make sure everything’s in order for your auditor:

- Organize your financial records.

- Review your internal controls.

- Reconcile your accounts.

- Compile any documentation your auditor requests.

Even for organizations with pristine financial records and management, audits can be stressful. Taking the time to prepare your nonprofit for an audit can make your team feel more at ease before the process begins.

7. File all tax forms correctly and on time.

Filing your tax forms (both Form 990 and employment tax forms like W-2s and 1099s) on time is not only important for maintaining compliance with the IRS. It also ensures you avoid any late fees that can add unnecessary expenses for your organization.

Let’s say you’re filing Form 1099, which reports on the non-employee compensation and miscellaneous income paid to contractors, freelancers, and vendors, or to recipients of rents, royalties, prizes, or awards. These forms are due to payees by January 31st each year, but in order to complete them correctly, you must first obtain a W-9 from the payee. By incorporating a policy to obtain a W-9 before paying any external parties, your nonprofit can facilitate meeting the January 31st deadline.

For each information return or payee statement, the IRS charges $60 for up to 30 days late, $120 for 31 days late through August 1st, and $310 after August 1st. Avoid incurring these fees and risking your tax-exempt status by setting calendar reminders for all necessary forms.

8. Hire a finance team with a background in nonprofit financial management.

To execute nonprofit financial management best practices, you need team members who can successfully support your operations. While you can hire an in-house finance team, we recommend outsourcing your accounting and bookkeeping services to keep costs low and unlock access to nonprofit-specific financial management expertise.

At YPTC, we’re committed to helping charitable organizations with their nonprofit financial management needs. We stand out from other providers because of our:

- Nonprofit expertise. From associations to foundations to schools to food pantries to museums to environmental organizations or anything in between, we’ve worked with a variety of nonprofits to help manage their finances. For three decades, we’ve worked with executive directors and board members to help them achieve their missions more efficiently and effectively.

- Flexible services. We’re ready to adapt to your needs, no matter which aspect of nonprofit financial management you need assistance with. YPTC can serve as your bookkeeper, accountant, controller, or Chief Financial Officer and customize our services to your nonprofit’s situation and goals.

- Assistance from anywhere. While we typically work with clients onsite, we can also assist your organization remotely. Whether we’re working face-to-face, over the phone, via video chat, or through emails, we provide that extra “personal touch” that makes our services stand out.

If you’re ready to partner with us for your nonprofit financial management needs, contact us today to get started.

Additional Nonprofit Financial Management Resources

To pursue your mission and make a difference for your beneficiaries, you must make sure your finances are in order. Proper nonprofit financial management ensures your organization is financially sound and stable so it can continue to provide good to its community for years to come.

If you’re interested in learning more about nonprofit financial management, check out these resources:

- Nonprofit Accounting: What Charitable Orgs Need to Know. Learn the ins and outs of nonprofit accounting in this guide.

- Demystifying Nonprofit Financial Statements: Complete Guide. Want a more in-depth explanation of all the nonprofit financial statements your organization must compile? Check out this article to learn more.

- What Is a Fractional CFO? Your Nonprofit Questions Answered. A fractional CFO is a flexible option for organizations looking for inexpensive, part-time help with their nonprofit financial management. Explore the services a fractional CFO provides and how you can hire one for your nonprofit.