Nonprofit Budgeting: What Your Organization Needs to Know

One of the greatest challenges of running a nonprofit is balancing what you want to accomplish with the resources you actually have. While nonprofits are typically strapped for cash, studies by Giving USA show that total giving decreased by 2.1% in 2023 when adjusted for inflation, meaning that charitable organizations must develop more clever approaches to allocating funds to effectively fulfill their missions.

Proper nonprofit budgeting is the key to maximizing your resources. Developing a budget gives your organization a roadmap for covering the costs you’ll incur, ensuring you have enough for all areas of your operations. We’ll help you create an impactful nonprofit budget by answering the following questions:

- What Is a Nonprofit Budget?

- Why Is Nonprofit Budgeting Important?

- What Are the Different Types of Nonprofit Budgets?

- What Are the Components of a Nonprofit Budget?

- Who Is Involved in the Nonprofit Budgeting Process?

- How Can You Develop an Effective Nonprofit Budget?

- What If I Need Help with Nonprofit Budgeting?

Once you’ve created your nonprofit budget, you’ll be on track to secure financial stability and sustainability for your organization. Let’s get started by exploring the basics.

What Is a Nonprofit Budget?

A nonprofit budget is a document that enables your team to plan for expenses and allocate resources. The main budget you’ll create is your operating budget, which details the costs you’ll incur and the revenue you’ll generate over the next year.

Beyond mapping out your expenses and revenues, this financial plan also helps you monitor your organization’s activities and ensure you use your funds wisely to support your mission. Since you’ll detail the source of each line item, you can pinpoint which areas need more resources and where you can cut back on spending.

Why Is Nonprofit Budgeting Important?

Nonprofit budgeting formalizes the process of allocating resources to different areas of your organization. It provides a concrete plan that you can use to evaluate your progress and align your team.

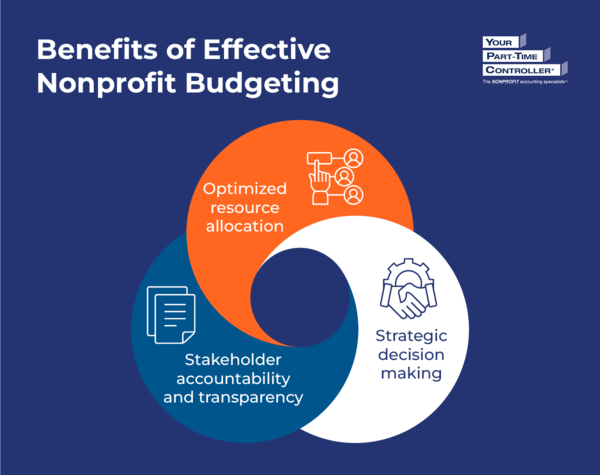

As a result, nonprofit budgeting offers your organization the following benefits:

- Optimized resource allocation. Developing a budget allows you to hone in on your priorities and allocate resources accordingly. That way, you can focus as much funding as possible on your top programs and services.

- Strategic decision making. Seeing your resource allocation laid out in front of you makes it much easier to plan for the future. You can predict future revenue and expenses based on historical financial data. Additionally, you can make more informed decisions about which areas you should invest in based on their associated revenue and expenses.

- Stakeholder accountability and transparency. Did you know that 67% of donors want to know all the details about how nonprofits use their funds? While you likely can’t trace back every dollar spent to the donor who contributed it, you can share your budget with donors, funders, board members, and other stakeholders to demonstrate transparency and prove that you’re using funds responsibly.

With a proper budget, your nonprofit can stay focused and organized while remaining accountable to the stakeholders who make your work possible.

What Are the Different Types of Nonprofit Budgets?

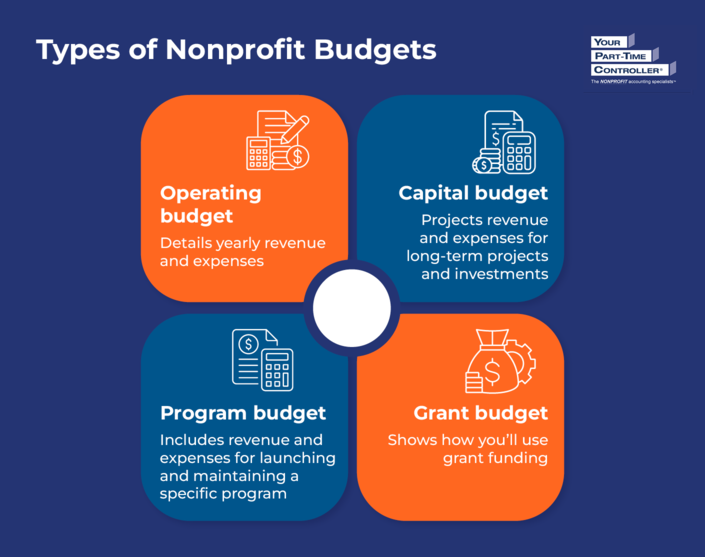

Thus far, we’ve discussed operating budgets, which include your annual projected revenue and expenses. However, there are also other types of nonprofit budgets you may need to create, such as:

- Capital budget. This budget allows you to project revenue and expenses for long-term projects and investments. For example, if you’re running a capital campaign to build a new facility, you’ll create a capital budget that includes the costs associated with developing this building and the revenue you expect to generate throughout the campaign to cover these costs.

- Program budget. Developing a new program may require creating a separate budget for that endeavor. This budget will include both one-time expenses for launching the program and ongoing costs for maintaining the program, the latter of which you’ll incorporate into your operating budget each year as well. Program budget expenses may include salaries for staff members working directly on the program and program-specific supplies and materials. Program budget revenues may include program fees and donations used for the program.

- Grant budget. Some grant funders may require you to submit a budget detailing how you’ll use the grant money to further your cause. Not only does developing a grant budget allow you to fulfill grant application requirements, but it also helps ensure proper resource allocation once you acquire grant funding.

Although each type of budget differs slightly in its intended purpose, they all still contain the same main components: revenues and expenses.

What Are the Components of a Nonprofit Budget?

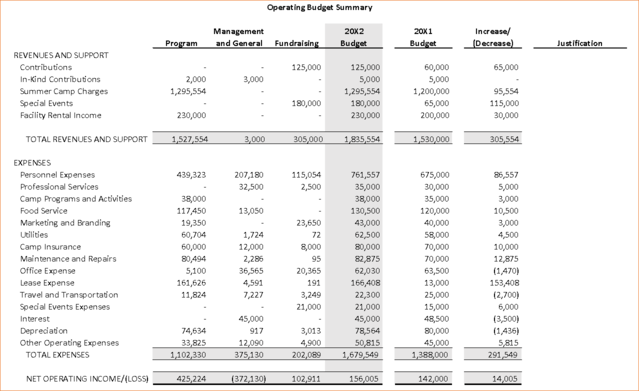

Revenues and Support

This category includes all the revenue you expect to generate. Use past financial data to forecast how much you can raise from different sources, such as:

- Individual donations, including small, mid-level, and major gifts

- Grants from government agencies, foundations, and other funders

- Membership dues paid by those belonging to your membership program

- Program fees directly related to the services you provide

- In-kind donations, which are nonmonetary contributions of goods or services

- Corporate philanthropy from sponsors and other charitable businesses

- Investment returns from endowment funds or other major investments

- Consulting fees charged for your expertise or services

- Rental income from leasing office space, facilities, or equipment

You’ll separate your revenue by source in your operating budget. Additionally, you’ll indicate whether these funds will come from program, management and general, or fundraising activities.

It can be tricky to accurately predict how much you’ll raise from each source and categorize these funds appropriately. If you need assistance, reach out to a nonprofit accounting firm that can take care of this forecasting and reporting for you.

Expenses

Next, you’ll predict the expenses you’ll incur for different initiatives. You’ll sort these expenses into the following categories:

- Program expenses. These costs are directly related to executing your mission via programs and services. For example, program materials and the salaries of staff members who directly conduct or supervise program activities would be program expenses.

- Management and general expenses. These costs are associated with your nonprofit’s overall administration and governance. Management and general expenses may include executive salaries, benefits administration, and payroll costs.

- Fundraising expenses. Lastly, fundraising expenses are costs incurred while raising funds for your organization. They may include campaign expenses, event costs, and staff time devoted to fundraising and development activities.

Like revenue, you’ll predict expenses based on what you’ve spent in different areas in the past. This process is easiest for fixed expenses, which stay constant each year. For example, the rent for your office is likely a fixed expense due to your contract with the building’s management company. However, you’ll also have variable expenses that change each year and may be more difficult to forecast. For instance, the costs of program materials and necessary transportation will likely shift over time.

For new expenses, request quotes from vendors or providers to budget for these costs as accurately as possible. For example, you may reach out to the new bus company you plan to use for your organization’s summer camp to estimate how much their services will cost.

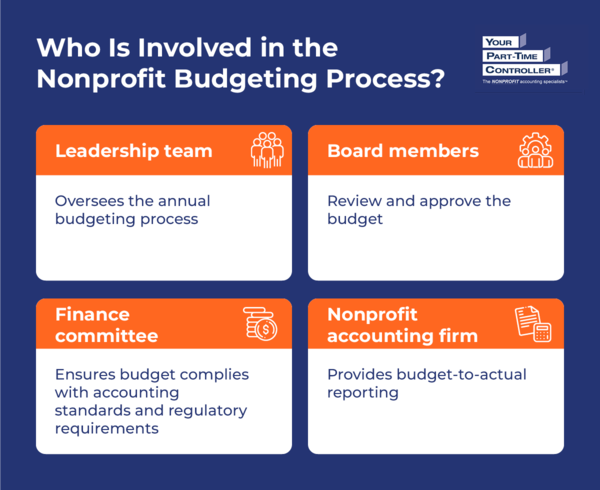

Who Is Involved in the Nonprofit Budgeting Process?

Creating a nonprofit budget is a large undertaking that requires different stakeholders’ input and expertise. Typically, the following groups will have a hand in the nonprofit budgeting process to ensure the resulting budget aligns with your mission and goals:

- Leadership team. Your executive director or CEO and senior management staff are responsible for managing your organization’s day-to-day financial operations, which includes overseeing the annual budgeting process. They’ll allocate resources to best serve your mission.

- Board members. Your board members provide strategic guidance, including financial oversight, to your nonprofit. They’ll review the budget to ensure it aligns with your organization’s current priorities and ultimately approve it.

- Finance committee. Since the finance committee has expertise in this area, they’re responsible for keeping your nonprofit accountable and transparent about its financial management. They’ll also review your proposed budget to ensure it’s reasonable and complies with accounting standards and regulatory requirements.

- Nonprofit accounting firm. Nonprofit accountants plan, record, and report your organization’s financial transactions. They provide budget-to-actual reporting, comparing your projected revenue and expenses to your actual spending and fundraising numbers to assess how well you adhere to the original budget.

Together, these stakeholders will ensure your budget is realistic, provide suggestions for improving it, and monitor your budgeting progress throughout the year.

How Can You Develop an Effective Nonprofit Budget?

You’ve got the budgeting basics down, but how do you ensure your budget is ultimately effective? We recommend following these tips and best practices.

Review historical financial data.

Use your nonprofit’s past financial data to create a realistic budget that aligns with your history. Leverage this information so your team can:

- Plan for recurring expenses. If you know how much you’ve spent on certain areas, you can more accurately plan for the future. Transfer fixed expenses to your budget and estimate variable expenses based on how they’ve changed over time. For example, when comparing financial data points from the past five years, you may notice that your marketing costs have increased by about 2% annually, allowing you to predict another 2% increase for the upcoming year.

- Account for seasonal variations. Determine if there are specific times of year when revenue increases or decreases to allocate resources accordingly. For example, you may have an annual fundraising event that drives major revenue or gather many individual donations during the holiday season.

- Identify risks. Let’s say you typically spend more than you project on administrative expenses. This context can help you proactively resolve this problem by allocating resources accordingly and reducing costs. For instance, you may downsize your office or rely more heavily on volunteers.

- Analyze past surpluses and deficits. While surpluses are typically considered favorable, a nonprofit surplus may indicate that your organization could allocate its resources more efficiently and invest more heavily in certain areas. On the other hand, if you had a deficit in the previous year, assess why that happened and how you can correct it in this year’s budget.

Keep financial data in a central platform like a nonprofit accounting system to ensure easy access for your team. Teach team members how to interpret this information and take advantage of the software’s reporting features to simplify their analysis.

Don’t fall into the overhead myth.

You may have heard that nonprofits should spend a certain amount on overhead expenses. Known as the overhead myth, the principle that nonprofits must stick to a certain percentage (typically estimated between 15 and 35%) is false.

There’s no magic number for overhead expenses. Each nonprofit will have its own optimal overhead allocation, depending on its age, size, geographic location, and specific needs.

Many nonprofits hesitate to reveal how much they spend on overhead costs with donors. Reframing overhead costs as stepping stones to making an impact can help donors understand why not all their funds go directly to programming.

Even still, some donors may be unwilling to contribute directly to overhead costs. This phenomenon is known as overhead aversion, and a study on the subject by behavioral economist Uri Gneezy finds that offering overhead-free donation opportunities to smaller donors can help bridge this gap.

You can carry out this strategy by working with major donors to cover overhead expenses and explaining to smaller donors what their contributions will allow you to accomplish. The study points to charity:water as an organization that has effectively implemented this strategy with a branch called “The Well” that collects donations from a small group of private donors to cover overhead costs.

Incorporate flexibility.

Sometimes, things don’t go according to plan, and you’ll want to ensure your nonprofit has enough resources in case of an emergency, economic downturn, severe revenue decrease, or other extending circumstances. Build flexibility into your budget to prepare for uncertainty and stay stable throughout any financial challenges. You can do so by:

- Including a contingency fund. A contingency fund is money you set aside to cover unexpected expenses or buffer against revenue fluctuations. Set aside a small percentage of your budget for this area and define what expenses this fund can cover.

- Prioritizing expenses. Some expenses are more critical for your mission than others. Sort expenses based on how essential they are to your underlying cause. That way, if you have to cut costs unexpectedly, you’ll know which areas to prioritize and which to reduce.

- Leveraging scenario planning. Scenario planning involves creating different versions of your budget based on your nonprofit’s best-case, worst-case, and most likely financial situations. These budget variations allow you to remain realistic and pivot quickly if necessary.

While you won’t be able to predict every challenge or shortcoming your nonprofit might face, you can prepare as best as possible by making your budget flexible.

Monitor and adjust your budget as needed.

Even if you base your budget on historical financial data and prepare for uncertainty, monitor your budget throughout the year to ensure you stay on track. Review your budget at these intervals:

- Monthly, to catch and correct any mistakes and compare your budgeted revenue and expenses with your actual numbers

- Quarterly, to assess financial performance, compare your budgeted and actual revenue and expenses, and review your grant budgets based on the grant funding you’ve acquired

- Annually, to analyze your financial performance and budget-to-actual reporting for the year to inform next year’s budget

Regularly reviewing your budget helps your organization detect and address issues early on, make well-informed financial decisions, and build trust with stakeholders by reporting on your findings.

What If I Need Help with Nonprofit Budgeting?

You may feel overwhelmed with everything that goes into the nonprofit budgeting process, and you’re not alone. At YPTC, we help charitable organizations budget effectively so they can accomplish more for their causes. Our nonprofit accounting firm stands out because of our:

- Nonprofit expertise. From foundations to higher education institutions to museums to animal welfare organizations, we work with nonprofits of all shapes and sizes. With three decades of experience, we understand your needs and can help your nonprofit’s team manage your finances more effectively and efficiently to fulfill your mission.

- Flexible services. Pick and choose which services your organization needs, including budgeting, scenario planning, financial reporting, accounting and month-end close, grant management, audit turnaround, data visualization, and more. We can serve as your bookkeeper, accountant, controller, or Chief Financial Officer (CFO), depending on what you’re looking for.

- Assistance from anywhere. Whether you seek onsite, hands-on assistance or remote correspondence via video chat, phone calls, and emails, we’re happy to help. No matter where we’re completing your services from, we provide that extra “personal touch” that makes us stand out.

If you’re ready to work with us for your nonprofit budgeting and other financial management needs, don’t hesitate to contact us so we can get started.

Additional Nonprofit Financial Management Resources

Nonprofit budgeting is an essential process that requires your organization to project revenue and expenses so you can allocate resources appropriately, plan for the future, and remain accountable to stakeholders. Remember to base your budget on your nonprofit’s specific needs and history.

Explore more nonprofit financial management best practices through the following resources:

- Demystifying Nonprofit Financial Statements: Complete Guide. Your budget isn’t only the financial document you must create. Learn about the four main nonprofit financial statements in this guide.

- What Is a Fractional CFO? Your Nonprofit Questions Answered. A fractional CFO can help you with budgeting, forecasting, scenario planning, and more. Dive into all a fractional CFO can offer your organization.

- Exploring Nonprofit Financial Management: The Ultimate Guide. Budgeting is part of the overarching nonprofit financial management umbrella. Check out other processes, policies, and best practices to keep your organization financially sound.

Jennifer Alleva

Jennifer Alleva is the Chief Executive Officer at Your Part-Time Controller, LLC (YPTC), a leading provider of nonprofit accounting services and #65 on Accounting Today’s list of Top 100 accounting firms. Jennifer brings over three decades of expertise in accounting and leadership to her role as CEO of YPTC.

When Jennifer joined YPTC in 2003, the firm consisted of just over 10 staff members. Since then, she has helped grow YPTC into one of the fastest-growing accounting firms in the country.

Jennifer’s accomplishments include her tenure as an adjunct professor at the University of Pennsylvania Fels Institute, her frequent speaking engagements on nonprofit financial management issues, her role as the founder of the Women in Nonprofit Leadership Conference in Philadelphia, and her launch of the Mission Business Podcast in 2021, which spotlights professionals and narratives from the nonprofit sector.