Nonprofit financial statements are reports that provide an overview of a nonprofit organization’s financial health. They are prepared based on Generally Accepted Accounting Principles (GAAP) and help organizations make resource allocation and other strategic decisions. They also play a crucial role in ensuring nonprofits remain accountable to stakeholders.

One of the main financial statements your nonprofit must compile is a Statement of Financial Position or nonprofit balance sheet. To get you up to speed on this specific document, we’ll answer all your nonprofit balance sheet questions, including:

- What Is a Nonprofit Balance Sheet?

- Why Do Nonprofits Need a Balance Sheet?

- How Does a Nonprofit Balance Sheet Differ from a For-Profit Balance Sheet?

- How Should You Interpret a Nonprofit Balance Sheet?

- What Metrics Can You Use to Analyze Your Nonprofit Balance Sheet?

- What If I Need Help Compiling My Nonprofit Balance Sheet?

First up on your journey to becoming a nonprofit balance sheet expert is exploring exactly what this financial statement entails.

What Is a Nonprofit Balance Sheet?

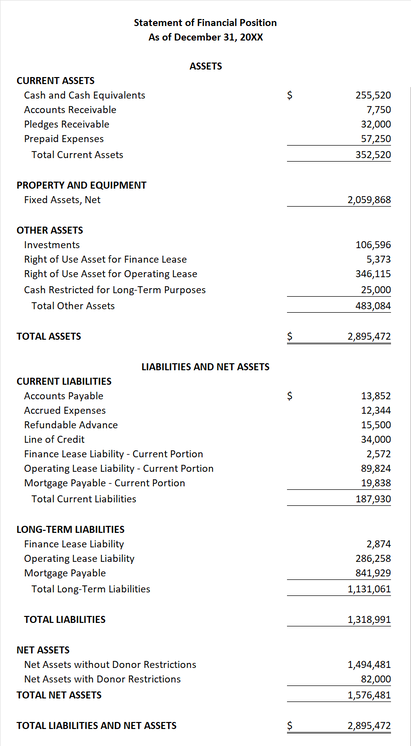

A nonprofit balance sheet (or nonprofit Statement of Financial Position) describes your organization’s financial health at a point in time. It provides information about your organization’s liquidity and financial flexibility through the following categories:

Assets

Any resource with economic value that your nonprofit owns or controls is an asset. While nonprofit assets are typically tangible items, some organizations may also own intangible assets like patents or copyrights.

Nonprofits categorize assets based on their liquidity:

- Current assets. Current assets are items you can convert to cash quickly (typically within a year). In addition to cash and cash equivalents, current assets include items like accounts receivable, pledges receivable, prepaid expenses like software subscriptions, and inventory.

- Noncurrent assets. On the other hand, noncurrent assets are assets the organization intends to hold for more than one year. Therefore, noncurrent assets include land, buildings, and equipment like computers and office furniture.

- Intangible assets. Intangible assets, such as patents and copyrights, are most often included in noncurrent assets. Additionally, restricted cash can be a noncurrent asset if the donor has restricted its use for long-term purposes.

Liabilities

Any financial debt or obligation of your nonprofit is a liability. Like assets, liabilities fall under different categories based on the time period associated with them:

- Current liabilities. Short-term obligations payable within the next year are current liabilities. These may include accounts payable, accrued expenses like staff salaries and rent, and deferred revenue. Deferred revenue is recorded when your organization receives payment but has not delivered the goods or services. For example, a nonprofit will record event ticket revenue as deferred revenue until the event occurs.

- Noncurrent liabilities. Long-term obligations payable in over a year are noncurrent liabilities. These may include mortgages and long-term lease obligations.

Net Assets

Your net assets represent the residual interest in your organization’s assets after subtracting your liabilities. In simpler terms, an organization’s net assets equal their assets minus their liabilities. Generally, nonprofits with higher net assets are financially healthier than those with lower net assets.

Nonprofits categorize net assets based on whether or not they have donor restrictions:

- Net assets without donor restrictions. Your organization is free to use these net assets however it wants. For example, nonprofits can often use membership fee revenue and general fundraising event donations however they see fit.

- Net assets with donor restrictions. These net assets have limitations that the donor places on their use. These net assets must be used for a particular purpose, or they may be limited for use at a particular time by the donor. Donor restrictions can be permanent or temporary. One of the most common examples of a permanently restricted net asset is an endowment fund.

Why Do Nonprofits Need a Balance Sheet?

Compiling a nonprofit Statement of Financial Position allows you to assess your organization’s financial health at a specific moment in time, make well-informed financial decisions, and build trust with stakeholders by providing financial insight into your organization. There are several instances in which you are required to present an accurate, up-to-date nonprofit balance sheet:

- Filing Form 990. Each year, your nonprofit must file Form 990 with the IRS to uphold its tax-exempt status. As part of the form, you’ll provide a balance sheet to showcase your organization’s financial health.

- During an audit. You may be required to have your organization’s financial statements audited. Auditors examine these reports for accuracy and compliance with Generally Accepted Accounting Principles (GAAP).

- Applying for grants. Many grant funders require applicants to provide a Statement of Financial Position. This document allows them to assess each organization’s financial stability and sustainability and factor this information into their award decisions.

Whenever your nonprofit needs to provide a balance sheet, ensure your team updates it to reflect your organization’s current financial standing. Typically, you’ll update your balance sheet at least annually when you file Form 990.

How Does a Nonprofit Balance Sheet Differ from a For-Profit Balance Sheet?

As we’ve discussed, a nonprofit balance sheet is often called a Statement of Financial Position. This version of the document has nonprofit-specific categories, including:

- Pledges Receivable. Pledges receivable are similar to accounts receivable; however, instead of representing amounts due from customers, they represent promises from donors to donate cash or other assets in the future. For example, a major donor may pledge to contribute $25,000 in installments over the next five years to support your capital campaign.

- Refundable Advance. Refundable advance is a nonprofit-specific liability that represents cash or other assets subject to donor-imposed conditions. It’s a liability because if the conditions aren’t met, you must return the contributed assets. For example, a foundation may provide grant funding for a research project under the condition that the nonprofit raises $100,000 from others. If the organization does not raise $100,000 from others, it must repay the grant dollars previously received.

- Board-Designated Net Assets. Nonprofits may also have net assets without donor restrictions set aside for the board’s discretion. They may earmark these funds for future programs, investments, contingencies, asset purchases, or other uses. When a nonprofit has board-designated net assets, it’s a sign the organization is thinking about the future and has the financial flexibility and stability to support upcoming initiatives.

Additionally, nonprofits and for-profits use slightly different terminology for their balance sheets. While nonprofits call the difference between their assets and liabilities “net assets,” for-profits refer to this term as “equity,” which represents the ownership interest or stake shareholders have in the company.

This difference stems from the fact that each type of organization has separate goals for its balance sheet. The for-profit balance sheet focuses on the organization’s capacity to generate profits and distribute earnings to shareholders. In contrast, the nonprofit balance sheet emphasizes accountability and responsible resource allocation, leading charitable organizations to report on net assets with and without donor restrictions.

How Should You Interpret a Nonprofit Balance Sheet?

Ultimately, a nonprofit balance sheet reveals whether your organization has sufficient resources to fulfill short-term and long-term obligations. To ensure you get the most valuable insights from this statement, follow these tips:

Assess each section equally.

It may be tempting to narrow in on one section of the balance sheet and make a quick assumption about your organization’s financial health. However, it’s the relationship between your assets and liabilities that tells the whole story.

Let’s say you focus on your nonprofit’s assets. If your organization has strong assets, you may assume it’s in a healthy position, but your liabilities may reveal significant debt coming due that your current assets can’t cover. Also, when you’re evaluating your assets, you may need to consider any donor-imposed restrictions. Your organization may have enough cash and other assets on hand to meet its short-term obligations. However, some of those assets may be restricted for a particular purpose and not available to pay general operating expenses.

On the other hand, if you focus solely on your liabilities, you may worry that they seem higher than usual and start to panic about how to address them. However, a review of your assets may indicate that even though your debts have increased, so have your assets and net assets.

That said, it’s important to examine each section in relation to the others to accurately determine your nonprofit’s current financial situation.

Investigate the context behind numbers that don’t reflect positively on your financial position.

What happens if you consider each section and still find alarming numbers on your nonprofit balance sheet? While there may be some legitimacy behind your concern, there’s no need to panic just yet.

When it comes to financial reporting, context is everything. While you typically want to see positive net assets, here are some potential scenarios that could account for a perceived dip in resources:

- Major projects. Let’s say your organization launches a new program. A large undertaking like this could be costly to your organization and, therefore, decrease your nonprofit’s net assets. In this case, a decrease in the organization’s net assets may not be a cause for concern because your organization deliberately used available resources to invest in future growth, enabling you to better serve your mission in the long run.

- Seasonality. Did you know that 34% of nonprofit online revenue from one-time gifts in 2023 came in during December? Year-end is a popular giving time, but you may have slow periods, too. Understanding when your donors typically give can help assuage any doubts about asset stagnancy during off times.

- High deferred revenue. As we discussed earlier, deferred revenue is a current liability that represents funds your organization has received for goods or services to be provided in the future. Although you report deferred revenue as a liability, these are actually funds your team may earmark for future programs, contributing to your nonprofit’s growth.

Remember that your nonprofit’s purpose is to fulfill its mission. Sometimes, what appears to be lessening resources results from your organization using what it has to make improvements and invest in your nonprofit’s future.

Consider trends over time.

Without knowing your nonprofit’s baseline, it’s difficult to determine whether its financial health is stable. Compare multiple balance sheets to consider trends over time and identify the norm for your nonprofit.

For example, you may find that while your net assets are lower than you’d like them to be, they’ve been steadily increasing over time, indicating growth and sustainability. You can also use your balance sheets to evaluate major financial decisions you’ve made by assessing statements from before and after the initiative and noting the impact on your organization’s overall financial health and stability.

What Metrics Can You Use to Analyze Your Nonprofit Balance Sheet?

Using data from your nonprofit balance sheet, you can calculate key metrics that demonstrate your organization’s short-term financial health. To unlock these insights, you’ll use the following formulas:

- Months of cash on hand. Calculate your months of cash on hand to determine your organization’s short-term liquidity. Divide your total cash and cash equivalents by your average monthly cash expenses (excluding non-cash expenses like depreciation). The result will tell you how long your nonprofit can handle its expenses without any additional income. A good rule of thumb is to have at least three to six months of cash on hand in case of unexpected costs.

- Current ratio. Another way to evaluate your short-term liquidity is with the current ratio. Divide your current assets by your current liabilities. Typically, nonprofits should strive for a current ratio greater than one, meaning they have adequate liquidity to meet short-term obligations over the next year. However, a ratio that’s too high may indicate the need to invest those excess funds in other areas of your organization.

- Months of liquid unrestricted net assets (LUNA). Since your organization will likely have at least some net assets you can’t quickly liquidate, the months of LUNA equation accounts for these unavailable funds. To calculate your organization’s LUNA, start with your total unrestricted net assets and subtract non-liquid assets, such as fixed and intangible assets. Then, divide your organization’s LUNA by your average monthly cash expenses. The result will tell you how long your nonprofit can handle its expenses with its liquid assets. Generally, nonprofits should have at least three months of LUNA, which indicates financial stability.

Again, remember to analyze these metrics in the context of past performance. Comparing these results to those from past balance sheets can reveal upward trends to capitalize on or downward trends to reverse.

What If I Need Help Compiling My Nonprofit Balance Sheet?

As you can see, there’s much to consider when creating and analyzing a nonprofit balance sheet. If you need help with this process, reach out to a nonprofit accounting firm like YPTC for assistance. Our firm stands out due to our:

- Nonprofit expertise. Over the past three decades, we’ve worked extensively with mission-driven organizations, including associations, foundations, museums, schools, environmental organizations, and more. We’re experts at helping nonprofit executive directors and board members manage their finances to more effectively and efficiently fulfill their missions.

- Flexible services. We customize our services to your nonprofit’s needs to find the perfect financial management solution for you. Whether you need a bookkeeper, accountant, controller, or Chief Financial Officer (CFO), we can take on the financial role you’re looking for. Mix and match our services, including financial reporting, accounting and month-end close, data visualization, budgeting, grant management, audit turnaround, and more.

- Assistance from anywhere. We work with clients onsite, so you can work with our experts face-to-face and ask them questions. However, we can also work with your nonprofit remotely via video chat, phone calls, and emails. Either way, we provide that extra “personal touch” that makes our services stand out.

Ready to have us handle your nonprofit balance sheet and any other financial management needs? Contact us today to get started!

Additional Nonprofit Accounting Resources

A nonprofit balance sheet is a necessity for your organization. This document allows you to properly allocate resources, make smarter financial decisions, and stay accountable to stakeholders. Compiling an accurate balance sheet ensures your organization is equipped to file Form 990 each year, conduct smooth audits, apply for grants, and, ultimately, assess its financial health.

To learn more about nonprofit accounting best practices, check out the following resources:

- Demystifying Nonprofit Financial Statements: Complete Guide. The nonprofit Statement of Financial Position is just one document your organization must produce. Explore the full set of nonprofit financial statements you’ll compile.

- Exploring Nonprofit Financial Management: The Ultimate Guide. Perfect your financial management strategy by learning who’s responsible for different roles, which policies to create, how to budget, and more.

- How to Fill Out a W-9 for Nonprofit Organizations: Key Steps. A W-9 is an IRS form you must complete when you work with an outside contractor. Check out how to fill out this form in this complete guide.