Picture this: it’s the end of the year, and donations are flowing in. You’re busy promoting your year-end fundraising efforts, processing donations, thanking donors, and keeping up with your regular programming.

Suddenly, you remember a third-party auditor is arriving today to review your financial statements and internal controls. While your financial documents are typically in line, you forgot to assemble new versions amidst the year-end chaos and review your financial records to ensure everything is correct.

It’s crucial to stay on top of financial management—not only to prepare for audits but also to ensure your organization is financially sound, responsible, and compliant with all relevant regulations. In this guide, we’ll walk you through the basics of a nonprofit audit and how to put your best foot forward:

- What Is a Nonprofit Audit?

- What Are the Different Types of Nonprofit Audits?

- When Do You Need to Conduct a Financial Audit?

- What Are the Benefits of Conducting a Financial Statement Audit?

- What Does the Nonprofit Audit Process Look Like?

- How Should You Decide on a Nonprofit Auditor?

- How Can You Prepare for a Nonprofit Audit?

- What If I Need Help Preparing for a Nonprofit Audit?

Let’s begin by defining a nonprofit audit and what it entails.

What Is a Nonprofit Audit?

A nonprofit audit is a review of a charitable organization’s financial records, transactions, practices, and internal controls. An audit can help your organization assess its financial health and procedures and identify room for improvement. It can also determine your compliance with relevant financial regulations and best practices to ensure you follow industry standards.

What Are the Different Types of Nonprofit Audits?

Depending on your goals, federal funding, and compliance status, there are several different types of audits your nonprofit may conduct. These nonprofit audit types include:

Financial Statement Audit

A financial statement audit is a detailed and independent examination of an organization’s financial statements and related disclosures to ensure they are accurate, complete, and compliant with Generally Accepted Accounting Principles (GAAP). The goal of a financial statement audit is to provide reasonable assurance that the organization’s financial statements are free of material misstatement.

Federal Audit

Also known as a single audit, a federal audit is a financial and compliance audit required for non-federal entities expending at least $750,000 or more in federal awards during a fiscal year. The $750,000 threshold will be raised to $1,000,000 for those organizations whose fiscal year begins on or after October 1, 2024.

A third-party auditor or firm certified in single audits conducts this type of audit to ensure the nonprofit has used federal funds for their intended purpose. The auditor also evaluates the effectiveness of the entity’s internal controls over compliance with federal program requirements. The nonprofit must submit its completed single audit report to the Federal Audit Clearinghouse (FAC) within 30 calendar days of receiving the auditor’s report or within nine months after the end of the fiscal year, whichever comes first.

IRS Audit

While not as common as business audits, the IRS does occasionally conduct nonprofit audits, even for tax-exempt organizations. This may be in the form of a field audit, in which the IRS agent visits your facility in person, or an office or correspondence audit, in which they conduct the audit remotely. They may also conduct a compliance check. The most common reason for an IRS audit of a nonprofit organization is inaccurate or incomplete reporting on Form 990, the federal tax return required for nonprofits.

Internal Audit

Members of your own team may audit your financials, too. Although an internal audit isn’t as objective, your team understands your nonprofit’s unique context and can make recommendations to improve your financial strategy.

While each type differs slightly, nonprofit audits generally aim to ensure your organization manages its funds properly and reports them accurately.

When Do You Need to Conduct a Financial Audit?

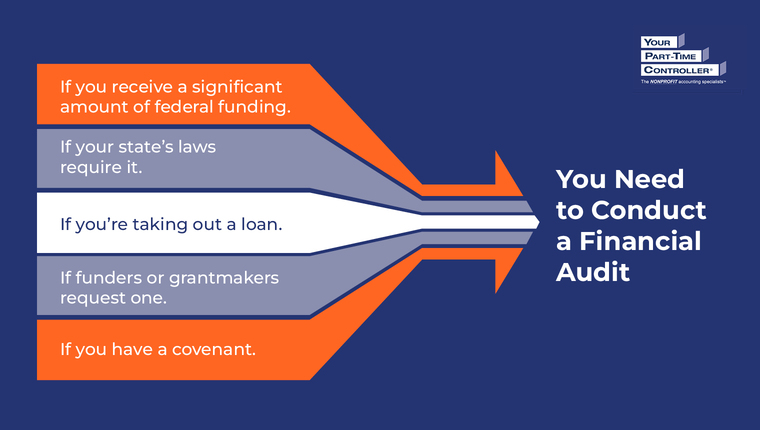

There are certain situations in which you’ll need to conduct a financial audit, including:

- If you receive a significant amount of federal funding. As mentioned previously, nonprofits that expend federal funds must undergo a federal audit. These expended funds include funds that were directly received from federal agencies and federal funds that pass through other entities first.

- If your state’s laws require it. Some states require audits for nonprofits based on the amount of state funding, total revenue in a fiscal year, or total contributions they receive. Check your state’s requirements to ensure your organization remains compliant.

- If you’re taking out a loan. To ensure your organization is financially stable and responsible, some banks may request you conduct an audit before approving your loan and annually throughout the life of the loan. A financial statement audit provides the bank confidence that your financial statements are accurate and helps the bank evaluate whether your organization will be in a position to repay the loan and meet its other financial obligations.

- If funders or grantmakers request one. Similarly, a funder or grantmaker may request an audit as part of a grant application to provide confidence that you’ll use the resulting funds responsibly. Looking at your financial records can assure them that you’ll manage the grant properly and use it for its intended purpose.

- If you have a covenant. A covenant is a specific financial commitment or agreement your nonprofit must adhere to in order to receive funding. For instance, a lender may require that your organization keep a certain debt-to-equity ratio or maintain a minimum level of unrestricted net assets. You may have to conduct a financial audit to prove your compliance with a covenant.

While it’s very likely your organization will fall into at least one of these categories, conducting an audit is beneficial regardless of whether you’re required to. Reviewing your financial statements and procedures allows you to assess your financial management and improve your strategy going forward.

What Are the Benefits of Conducting a Financial Statement Audit?

The most common type of nonprofit audit is a financial statement audit. Whether you’re required to conduct one or have decided your organization should undergo one, you’ll receive the following benefits from this process:

- Enhanced accountability. Knowing that an outside person or organization will review your nonprofit’s financial statements and transactions prompts your organization to hold itself accountable for proper financial management. In preparing for an audit, you ensure your organization meets industry standards and manages resources responsibly.

- Better risk management. A financial statement audit can illuminate potential financial risks. When you conduct regular audits, you can stay on top of these threats and mitigate their impact on your organization.

- Improved financial processes. In addition to the financial statements themselves, a nonprofit audit may dive deeper into your financial practices and internal controls, allowing your organization to tighten up any weaknesses.

- Increased transparency with stakeholders. Sharing your audit results with donors, volunteers, board members, and other stakeholders can build trust and demonstrate your commitment to precise, accurate financial reporting.

- More positive reputation. This level of financial transparency can inspire stakeholder confidence, leading to a more positive view of your organization. Plus, if you communicate that your nonprofit conducts regular audits on your website, potential donors and funders may think more highly of your organization and be more likely to contribute.

Overall, conducting a financial statement audit allows your organization to improve its internal financial management strategy and relationships with external stakeholders.

What Does the Nonprofit Audit Process Look Like?

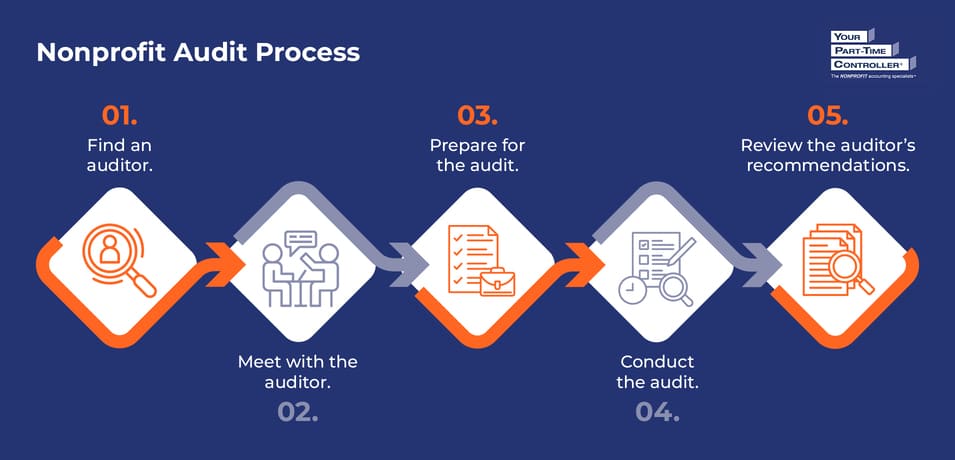

Now that you understand the basics of nonprofit audits, you may be wondering what this process actually entails. We’ll walk through each step of the nonprofit audit process so you know exactly what to expect:

1. Find an auditor.

Start by convening an audit committee or relevant board committee to select the auditor you’ll work with. This committee will prepare requests for proposals (RFPs) that outline what you’re looking for the auditor to accomplish and interview potential auditing firms. At the end of this step, you’ll decide on which auditor to move forward with.

2. Meet with the auditor to establish expectations.

In this meeting, you’ll discuss how the auditor will conduct the audit, the timeline of the entire audit process, and any concerns you may have. That way, you ensure everyone is on the same page and communicate everything proactively.

We recommend setting goals for what a successful audit will look like, such as a “clean” or unqualified audit opinion, no proposed audit adjustments, a management letter without significant deficiencies or material weaknesses, an audit draft within 60 days after your fiscal year-end, and audit completion within 90 days.

3. Prepare for the audit.

Next, you’ll work with your team to make sure you have everything the auditor needs to review, such as financial statements, bank statements, and tax documents. We’ll dive deeper into how you can best prepare later.

4. Conduct the audit.

During the audit, the auditor will review the financial records and documents you’ve provided. If they’re conducting a financial statement audit, there are three main types of procedures they may perform:

- Planning and risk assessment procedures, which involve identifying and analyzing financial risks, such as reporting errors, fraud, and cybersecurity threats.

- Substantive testing, which refers to the steps auditors take to test the accuracy of financial statements.

- Analytical procedures, which are techniques auditors use to analyze and evaluate financial information by studying relationships among financial and non-financial data. These procedures help auditors identify trends, discrepancies, or unusual transactions that may require further investigation.

5. Review and implement the auditor’s recommendations.

Once the auditor has finished, you’ll review their recommendations and implement them to improve your financial operations. Reflect on your goals, and if you have any shortcomings, determine how you can rectify them.

To help you navigate the audit process, let’s dive deeper into some of the steps we’ve presented here and provide some additional context that will help you take action.

How Should You Decide on a Nonprofit Auditor?

In the last section, we discussed assembling an audit committee to select a nonprofit auditor. But what exactly should your committee do to make the best decision possible for your organization? We recommend following these steps:

- Determine your auditing needs. Focus your efforts by narrowing in on the type of audit you need and what you’d like to get out of it. For example, if you’re required to conduct a single audit, you’ll need to find an auditing firm that’s federal audit certified. Or, if you just want someone to check your internal controls, make sure that’s clear.

- Research your options. Look into the different providers available to you online. We recommend choosing an auditing firm that specializes in nonprofits and has experience working with similar organizations for best results.

- Seek out recommendations. Reach out to other nonprofits you have existing relationships with to see if they have any auditors they recommend. You may even ask your nonprofit’s accountant for recommendations based on the auditors they’ve worked with for other clients.

- Issue requests for proposals (RFPs). Compile RFPs for each auditor you’re considering. Make sure to include details about your organization’s financial structure and size, the services you’ll need, and your objectives. Then, interview potential firms to learn more about them and see if they’d be a good fit for your nonprofit.

- Decide which auditor to work with. After you’ve evaluated your options and reviewed their proposals, work with your committee to decide on an auditor.

At the end of this process, you’ll meet with the auditor you’ve chosen to finalize your contract and further discuss the details of your arrangement.

How Can You Prepare for a Nonprofit Audit?

While we recommend remaining audit-ready year-round by staying on top of your financial transactions and reporting, here are steps you can take to prepare for a nonprofit audit:

- Reconcile your accounts. Ensure your financial statements match your internal financial records.

- Update your list of vendors. Add any new vendors you’ve started working with since your last audit, and remove any you’ve stopped working with.

- Assemble all financial documents your auditor requested. In addition to your financial statements, these may include bank statements, investment statements, tax documents, fiscal policies, general ledger, payroll records, donation and grant records, leases, and vendor contracts.

- Resolve any data entry errors. Fix any inaccuracies in your financial documents, such as duplicate, missing, or incorrect data.

- Review your accounts payable and receivable. Update your accounts payable and receivable as needed to ensure your outstanding liabilities and assets are accurate.

Keep your team organized by creating a checklist with everything you need to accomplish before your audit. Distribute responsibilities to different staff members and follow up to make sure everyone executes their roles properly.

What If I Need Help Preparing for a Nonprofit Audit?

It can be overwhelming to add audit preparation to your never-ending to-do list of responsibilities. Fortunately, YPTC is willing and ready to help you prepare for your nonprofit audit and lend our financial expertise to your team.

Our team of expert nonprofit accountants will prepare the necessary work papers and schedules for your auditor and coordinate with them to fill out your Form 990. We can also help you with your month-end close so you can stay audit-ready throughout the year.

Our firm stands out due to our:

- Nonprofit expertise. Over the past three decades, we’ve worked with organizations of all kinds to manage their finances. Whether you run a faith-based organization, foundation, higher education institution, association, museum, youth development organization, or something entirely different, chances are we have experience working with a similar nonprofit and will quickly understand your organization’s needs.

- Flexible services. In addition to audit preparation, we offer a multitude of other financial services you can mix and match, including budgeting, financial reporting, accounting and month-end close, grant management, scenario planning, data visualization, and more. We can serve as your bookkeeper, accountant, controller, or Chief Financial Officer (CFO).

- Assistance from anywhere. We work with nonprofits onsite to provide hands-on assistance, but we’re also happy to work with your organization remotely via video chat, phone calls, and emails. Either way, we provide that extra “personal touch” that makes our firm stand out from the crowd.

Contact us today to start preparing for your upcoming audit and getting your financial records in line.

Additional Nonprofit Audit Resources

While a nonprofit audit may be something your organization is required to do, it’s also a chance to confirm your financial practices are sufficient or improve upon your strategy. Either way, you’ll learn exactly what you have to do to keep your nonprofit financially sound so you can continue allocating funds to your mission responsibly.

If you’d like to learn more about how to tackle the nonprofit audit process, check out these additional resources:

- Audit Preparation for Nonprofits. Explore our approach to audit preparation and how we can help your organization.

- Reducing Audit Stress for Nonprofits Featuring Justine Townsend. Check out this presentation from seasoned YPTC manager Justine Townsend to learn the importance of staying proactive and how to reframe your mindset on the nonprofit audit process.

- Exploring Nonprofit Financial Management: The Ultimate Guide. Staying on top of your financial management will make audit preparation a breeze. Learn nonprofit financial management best practices you can incorporate in this guide.