Nonprofit Accounting: What Charitable Orgs Need to Know

Updated On: 11/25/2025

As a nonprofit professional, your strong suit is likely fundraising, volunteer management, and beneficiary programming. These mission-sustaining activities are central to your organization. However, certain underlying processes also need to occur behind the scenes to keep your nonprofit running smoothly—responsibilities that many nonprofit leaders aren’t as confident about.

One of the most important of these processes is nonprofit accounting. Properly managing your organization’s finances and allocating your resources is crucial to keeping your nonprofit afloat and ensuring you can continue to carry out your mission.

To help you better understand the ins and outs of nonprofit accounting and improve financial management, we’ve developed this guide that covers the following topics:

- What is Nonprofit Accounting?

- Nonprofit Accounting vs. For-Profit Accounting

- Nonprofit Accounting vs. Bookkeeping

- Key Nonprofit Accounting Documents

- Nonprofit Accounting Best Practices: 5 Tips

- Hiring vs. Outsourcing for Nonprofit Accounting

- Why YPTC is the Right Choice for Your Nonprofit Accounting Needs

With a better grasp of key nonprofit accounting concepts, you can be confident that you’re properly managing your finances and remain compliant with all relevant rules, regulations, and guidance, including Generally Accepted Accounting Principles (GAAP). Less stress about the nitty gritty of nonprofit finances means more time and energy to focus on what matters most: your mission.

Unlock nonprofit accounting expertise that puts your mission first.

What is Nonprofit Accounting?

Nonprofit accounting is how charitable organizations record, track, summarize, and report their financial transactions. Since nonprofits operate to better society and source their revenue through donations and grants, their accounting and financial reporting practices look different from those of for-profit organizations.

Nonprofit Accounting vs. For-Profit Accounting

Since nonprofits don’t secure revenue for internal gain, nonprofit accounting is all about staying accountable for your finances, instead of making a profit. Charitable organizations rely on donors and grant funders to obtain the funds they need. As a result, they must spend these funds according to donors’ and grant funders’ terms and restrictions.

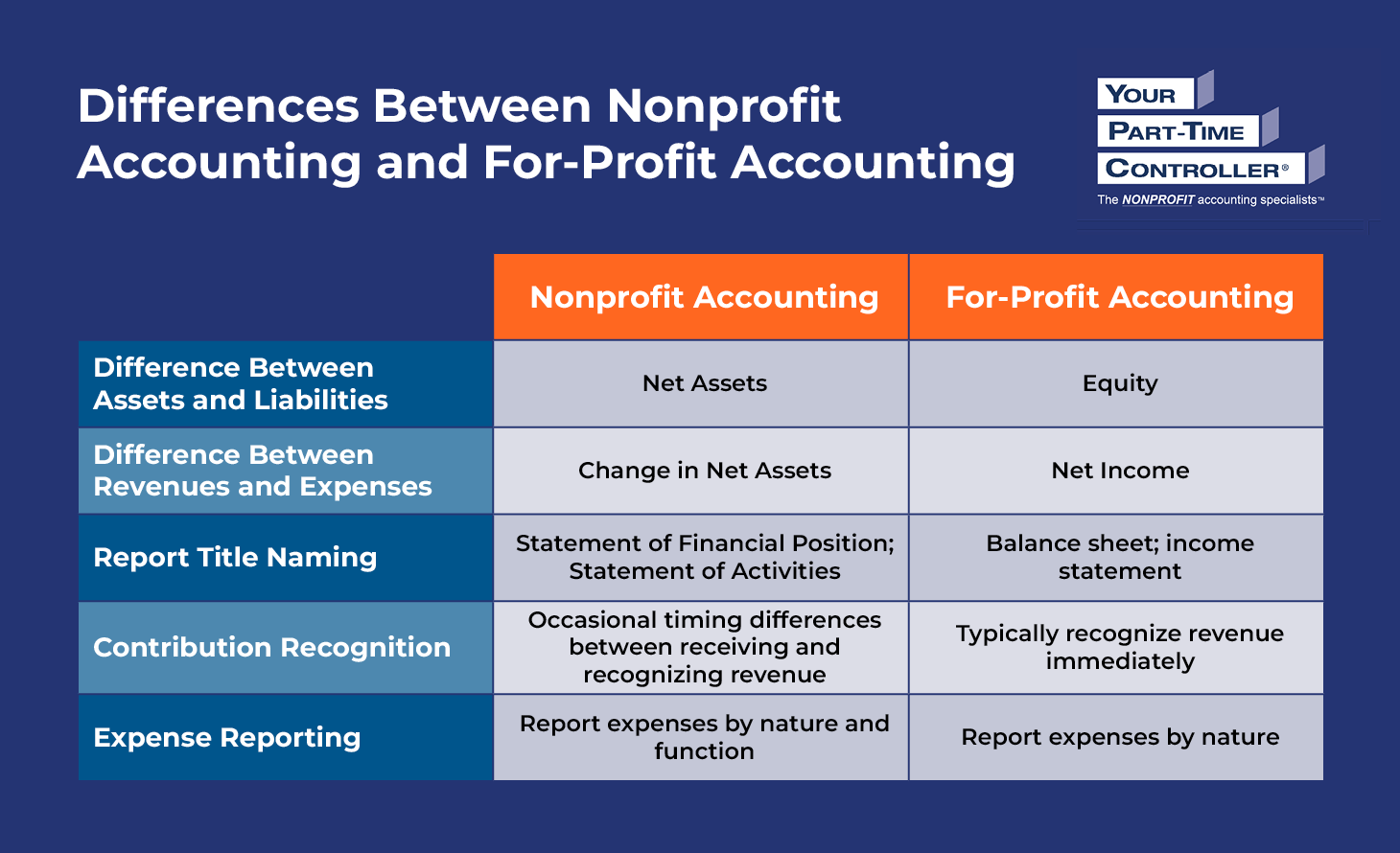

The following are key differences between nonprofit and for-profit accounting practices and terminologies:

-

- Equity vs. Net Assets: In a for-profit organization, the difference between assets (items owned) and liabilities (items owed) is called “equity,” which represents the ownership interest (equity) that shareholders have in the company. Because nonprofit organizations do not have owners, the difference between assets and liabilities is labeled “net assets.” Under current accounting guidance, nonprofits must classify net assets based on whether or not they have donor-imposed restrictions on their use. For example, a major donor may specify that their donation to their alma mater must be used to build a new library on the university’s campus.

- Net Income vs. Change in Net Assets: While in a for-profit organization, the difference between revenues and expenses is “net income,” in nonprofit accounting, this difference is referred to as the “change in net assets.”

- Report Titles: Nonprofits and for-profits must prepare similar reports, but the terminology used to describe them is slightly different. For example, a nonprofit’s balance sheet is known as a Statement of Financial Position, and its income statement is known as a Statement of Activities.

- Contributions: The rules surrounding the receipt and recognition of contributions are one of the most important differences between for-profit and nonprofit accounting. Nonprofit contributions may come with strings attached, leading to potential timing differences between when a nonprofit receives cash and when it recognizes this revenue in its financial reports. A common case of this scenario is matching pledges or challenge grants, wherein a donation is contingent on achieving some other goal (usually another donation).

- Expenses: Whereas for-profits report their expenses by nature, nonprofits must report expenses by both nature (expense line) and function (program services and supporting activities). Most organizations choose to meet this requirement by preparing a separate financial statement, known as the Statement of Functional Expenses.

These accounting differences are reflected within the financial statements that nonprofit organizations prepare, which we’ll review in more detail in a later section.

Nonprofit Accounting vs. Bookkeeping

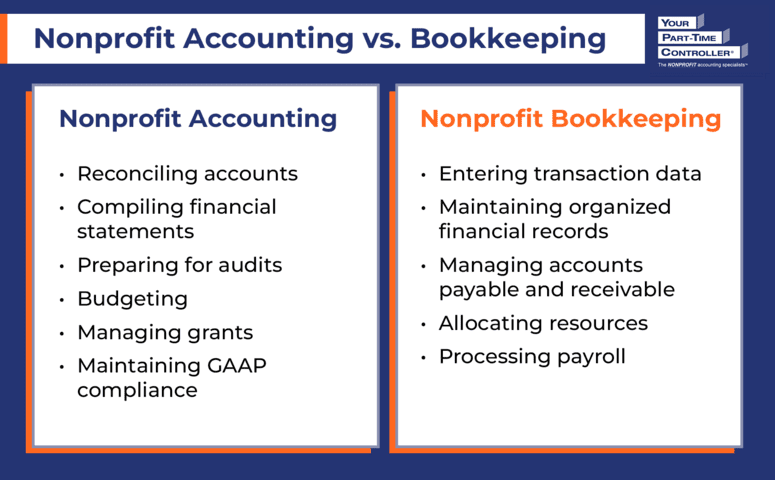

While you may use the terms “accounting” and “bookkeeping” interchangeably, they are different yet related concepts. Understanding this difference can help you distribute responsibilities among your team appropriately and determine which services your nonprofit may need to outsource.

Nonprofit Accounting

As we’ve already discussed, nonprofit accounting focuses on planning, recording, and reporting on financial transactions. The following activities fall under the umbrella of nonprofit accounting:

- Reconciling accounts

- Compiling financial statements

- Preparing for audits

- Budgeting

- Managing grants

- Maintaining GAAP compliance

Accountants typically must have at least a four-year degree, and some may be licensed Certified Public Accountants (CPAs).

Nonprofit Bookkeeping

On the other hand, nonprofit bookkeeping involves keeping up with your nonprofit’s day-to-day financial activities. It’s less complex than nonprofit accounting and encompasses the following activities:

- Entering transaction data

- Maintaining organized financial records

- Managing accounts payable and receivable

- Allocating resources

- Processing payroll

Bookkeeping does not require specialized education like accounting does. Consequently, a volunteer or staff member may be able to serve as your nonprofit’s bookkeeper, but a qualified accountant or accounting firm should handle your organization’s accounting needs.

Key Nonprofit Accounting Documents

Accountants across all sectors follow GAAP. The Financial Accounting Standards Board (FASB) establishes these principles to promote consistency in financial reporting and increase financial transparency.

When following GAAP, your nonprofit will have to create and use several documents to demonstrate your organization’s financial health. We’ll review these documents in depth.

Chart of Accounts

Your chart of accounts lists all the accounts your nonprofit uses to record transactions in its accounting system. Setting up your chart of accounts properly helps you better report and analyze your organization’s finances.

A nonprofit chart of accounts typically includes these main categories:

- Assets, which include resources your organization owns, like cash and receivables, as well as fixed assets, like buildings and equipment

- Liabilities, which are debts your organization owes, such as payables, accrued expenses, mortgages, and loans

- Net Assets, which are your currently available financial resources

- Revenue and Support, which includes money your nonprofit generates through program income, donations, grants, and investments

- Expenses, which are costs your organization incurs

The exact design of your chart of accounts will depend on your reporting needs. You’ll likely also create sub-accounts to further organize items in each category. For example, you may have a Direct Contributions header account under Revenue and Support, with sub-accounts for individual contributions, legacies and bequests, and corporate contributions.

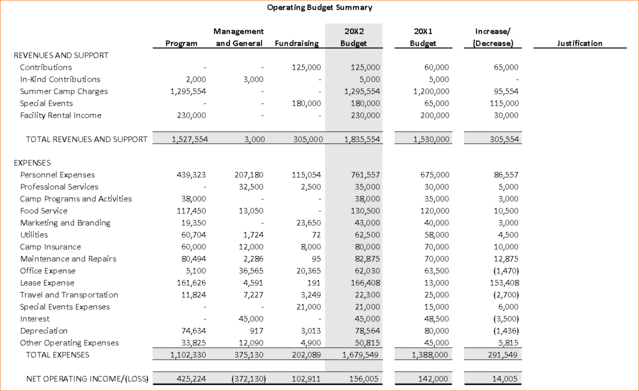

Nonprofit Operating Budget

Your nonprofit’s budget is a foundational financial document that allows your team to plan for expenses and allocate resources. Most organizations create a yearly budget that details all of the costs their nonprofit expects to incur and the revenue they’ll generate over the next 12 months.

Your nonprofit’s annual operating budget will likely end up looking something like this:

The operating budget is more than just a financial plan projecting income and expenses for the year—it’s a tool you can use to monitor your organization’s activities. Use your operating budget to determine the best uses of funds to accomplish your mission. Monitor your budget monthly and compare it to your actual results so you can stay on track and make adjustments where needed.

In addition to an annual operating budget, nonprofits often prepare project or grant budgets to meet funders’ reporting needs. You may also create program budgets to organize new program costs or event budgets to plan event expenses. Thus, the ability to track income and expense items by funding source is an important function of nonprofit accounting.

Nonprofit Financial Statements

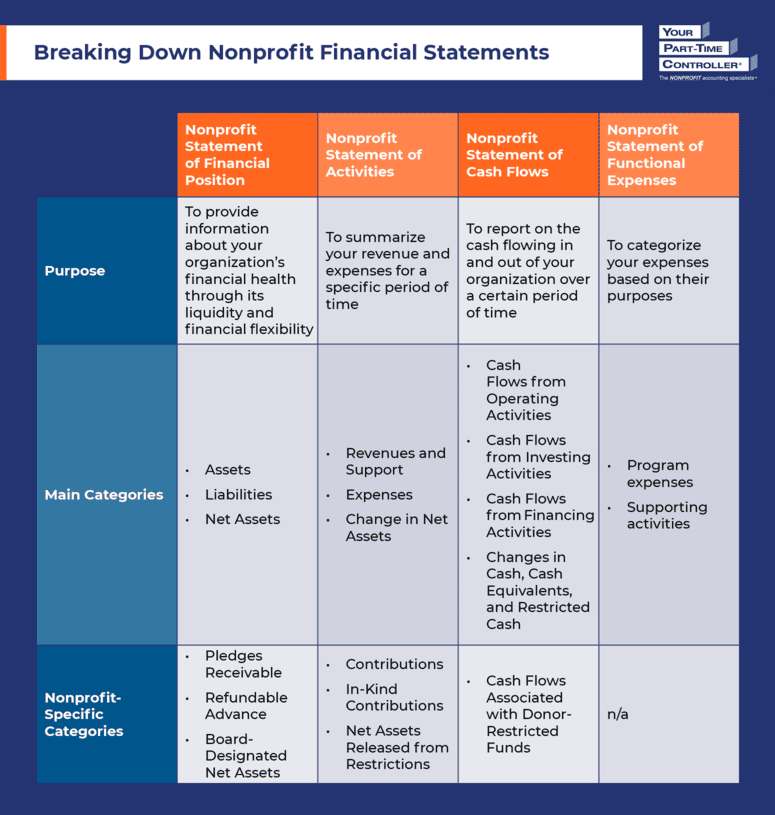

A full set of nonprofit financial statements includes:

- Statement of Financial Position

- Statement of Activities

- Statement of Cash Flows

- Statement of Functional Expenses

Let’s explore each of these in greater detail.

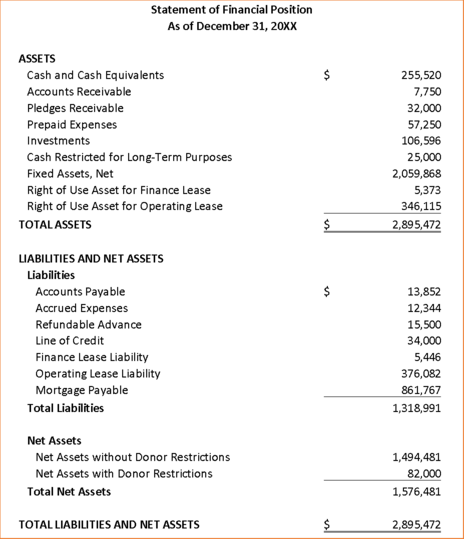

Statement of Financial Position

The Statement of Financial Position is a nonprofit’s balance sheet. It shows your organization’s financial health at a point in time.

Your Statement of Financial Position provides information about your liquidity and financial flexibility through the categories in the following equation:

Net Assets = Assets – Liabilities

When you subtract any outstanding financial obligations from your available resources, you can better evaluate your nonprofit’s financial standing. Positive net assets mean your organization is in a suitable financial position to reinvest its surplus of resources. Negative net assets indicate that your nonprofit should reevaluate its resource allocation to promote future growth and stability.

Refer to the example below to see what a Statement of Financial Position looks like:

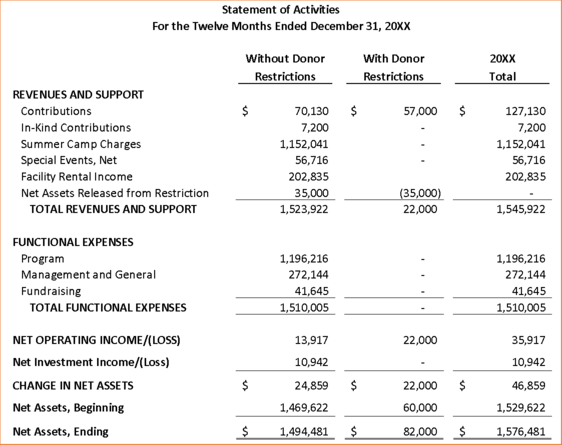

Statement of Activities

Your nonprofit’s Statement of Activities, or income statement, breaks down its revenue and expenses over time—typically one year.

The Statement of Activities also allows you to track changes in your net assets year over year and helps stakeholders understand how your nonprofit manages its resources to fulfill its mission.

Here’s an example of what your Statement of Activities might look like:

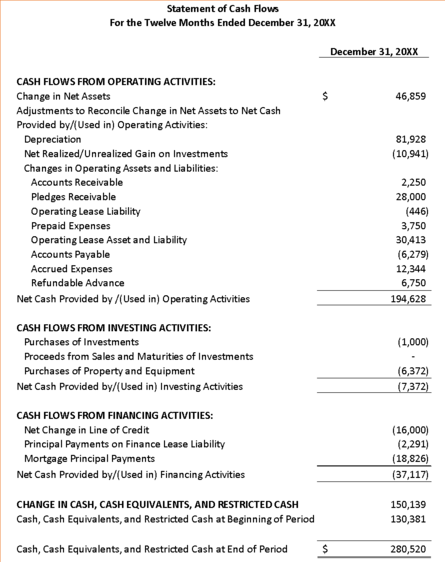

Statement of Cash Flows

Your nonprofit’s Statement of Cash Flows shows how cash moves in and out of your organization. It demonstrates cash flows from your operating, investing, and financing activities to reveal how cash is generated and used in different areas of your nonprofit.

This statement allows you to determine how much money you have available to pay your expenses. You can also better understand how your organization manages the funding it receives through this document.

Your Statement of Cash Flows likely will look something like this:

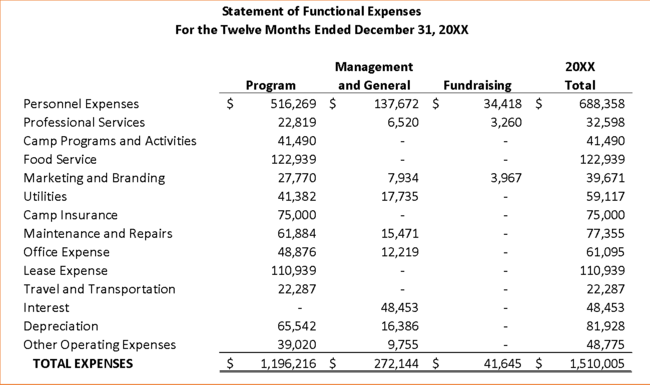

Statement of Functional Expenses

Under GAAP, nonprofits must provide an analysis of their expenses by nature and function. Most choose to do this in a separate statement: the Statement of Functional Expenses. This document separates your expenses into different categories based on their function. Nonprofits typically show the following functional expense categories:

- Program expenses

- Supporting activities, such as

- Management and general expenses

- Fundraising expenses

- Membership development expenses

You’ll also need to delineate the nature of each expense. For instance, you’ll separate staff compensation from rent and utilities, even though both are overhead expenses.

This document allows you to be transparent with donors, funders, board members, and other stakeholders about how you’re allocating your resources. Additionally, creating a detailed Statement of Functional Expenses will help you fill out the expenses section of your Form 990, simplifying the filing process.

Check out an example of a nonprofit Statement of Functional Expenses:

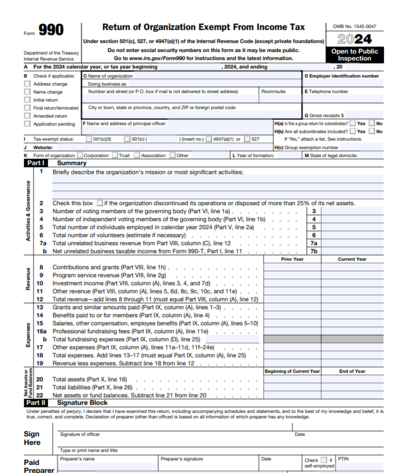

Form 990

Most tax-exempt nonprofits must file Form 990 with the IRS each year. Form 990 is the annual tax form that confirms your compliance with IRS regulations and requirements and maintains your tax-exempt status. While Form 990 is the standard version of the form, there are also different variations, such as the Form 990-N for small nonprofits, Form 990-EZ for mid-sized organizations, and Form 990-PF for private foundations.

Your Form 990 is a publicly available document that promotes financial transparency and provides evidence that your nonprofit operates as a 501(c)(3) should. It also provides nonprofit management with the opportunity to share program accomplishments and reflect on the impact its services have on the community.

Here’s an example of what this important nonprofit accounting document looks like:

Other Tax Forms

In addition to Form 990, there are other tax forms your nonprofit must complete to maintain compliance. These include:

- State-specific tax forms. Depending on your state, you may have to fill out additional forms to remain exempt from state income and sales taxes. Additionally, some states require nonprofits to fill out charitable solicitation registration forms before they can solicit donations in the state. For instance, nonprofits in Pennsylvania are automatically exempt from state income tax, whereas organizations in Arkansas must submit a copy of their IRS Determination Letter, the first two pages of IRS Form 1023, and a statement declaring exemption under the Arkansas Code.

- Employer tax forms. Your nonprofit must help its employees file their own tax returns by issuing Form W-2 to each employee on your payroll by January 31st each year. Additionally, you’ll file Form W-3 with the Social Security Administration to summarize the year’s W-2s. If you employ any independent contractors and pay more than $600 for their services, you’ll also have to file Form 1099 by January 31st to report on the income you pay them.

Now that you have a better understanding of these key nonprofit accounting statements and reports and their purposes, it’ll be much easier for you to assess your organization’s financial health. However, the next step is to learn how to properly implement this information and use it to inform your accounting decisions.

Unlock nonprofit accounting expertise that puts your mission first.

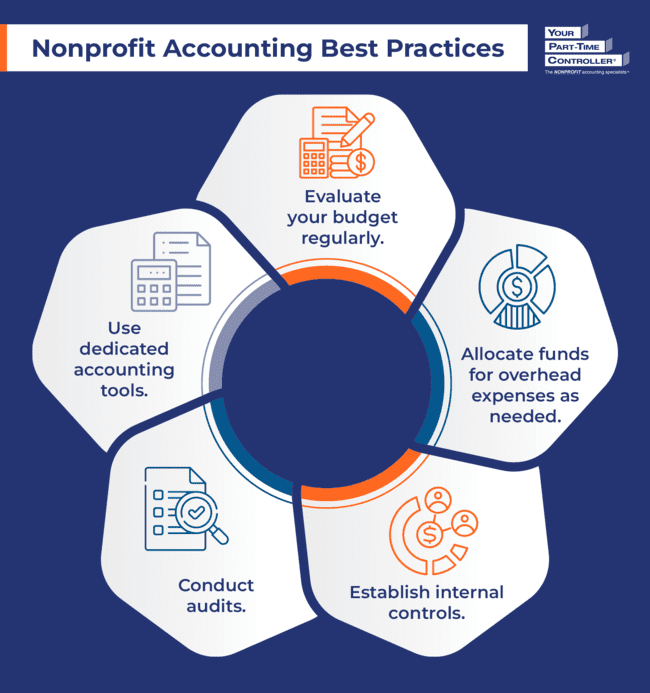

Nonprofit Accounting Best Practices: 5 Tips

Whether you’re handling your nonprofit accounting needs in-house or outsourcing these responsibilities, it’s important to abide by industry best practices. We recommend implementing the following tips to manage your finances efficiently and effectively.

1. Evaluate your budget regularly.

Since your budget is your guiding financial document, you’ll want to revisit it frequently. Ideally, you should check your budget once a month so you can compare your budgeted revenue and expenses to your actual revenue and expenses.

By identifying discrepancies in a timely manner, you can make necessary adjustments to your resource allocation and get back on track sooner. Additionally, this practice ensures your organization adapts to any changes in revenue or expenses, whether that be a new grant that increases your funding, heightened facility rent that raises your overhead expenses, or anything in between.

2. Allocate funds for overhead expenses as needed.

While nonprofits generally try to limit their overhead costs to ensure they’re directing the majority of their funds toward their mission, these expenses are necessary for your organization to function properly.

Paying your staff, acquiring office space, and creating a website, for example, all fall under overhead expenses. Where would your organization be without people to run it, a place to carry out your important work, and a website that promotes your mission and services?

While the general rule of thumb is to not exceed spending 35% of your funding on overhead expenses, every organization’s expense breakdown will look different. Instead of blindly cutting overhead costs to reach a certain percentage, be strategic about limiting your overhead, and ensure you’re allocating enough funds to this area to keep your nonprofit running smoothly.

3. Establish internal controls.

3. Establish internal controls.

With proper internal controls in place, you can limit fraud, identify errors, and protect your assets. No matter the size of your nonprofit, having appropriate checks and balances is necessary for effective financial management.

To ensure your internal controls are sufficient, follow these guidelines:

- Separate financial responsibilities. When you separate financial duties among your team, you prevent individuals from having too much control over your organization’s finances. For example, the staff member who records financial transactions should be different from the one who approves these same transactions.

- Implement clear financial policies. Create policies and procedures surrounding expense approval, cash handling, payroll processing, budget management, and financial reporting. Make sure your staff members are familiar with these policies and can easily reference them as needed.

- Conduct physical asset checks. While you likely have several sets of eyes on your financial records and transactions, don’t forget about your physical assets. Store cash and checks in safes or locked cash boxes, and keep stock of valuable office equipment, such as computers and cell phones.

Internal controls allow you to be more confident in the accuracy of your financial records and increase accountability among members of your nonprofit accounting team.

4. Conduct audits.

Auditing your organization’s financials regularly ensures they provide an accurate and complete picture of your nonprofit’s financial health for the stakeholders who use them. Audits also help you identify any risks that may jeopardize your nonprofit’s financial stability and opportunities to improve your financial management practices.

You can publish the results of your audit to build trust and increase transparency with donors, grantors, and other stakeholders. Demonstrating integrity, transparency, and responsible resource use over time will cultivate trust and encourage funding providers to continue lending their support.

5. Use dedicated accounting tools.

The right software can take your nonprofit accounting efforts to the next level. Make sure to choose a solution with nonprofit accounting settings and features that will make it easier for your team to manage your organization’s finances.

If you’re thinking about outsourcing your accounting needs, choose an expert or firm that not only specializes in nonprofit bookkeeping and accounting but that also uses tools your organization can quickly familiarize itself with. The experts you hire should act as an extension of your team and work with your staff to effectively manage your nonprofit’s finances.

Hiring vs. Outsourcing for Nonprofit Accounting

Hiring vs. Outsourcing for Nonprofit Accounting

Your nonprofit may already have someone on staff who fulfills your accounting needs. However, many nonprofits struggle to fill this role and round out their teams, with 74.6% of organizations reporting job vacancies. If you can’t find someone for the job, you may need to explore alternative options.

Take a look at the different ways your organization can cover its nonprofit accounting needs:

- Have an executive step up. At your nonprofit’s inception, you may assign all financial responsibilities to the executive director. While this approach may work in the beginning, your accounting needs will likely grow more complex as your organization expands. Additionally, your executives will need to take on other responsibilities, leaving them little time to focus on financial management.

- Hire a full-time accountant. Large nonprofits often hire a full-time accountant to join their team and manage their finances. However, as we discussed before, it can be difficult for organizations to fill these roles, and smaller nonprofits may not have the means to hire additional staff.

- Partner with a nonprofit accounting firm. For many organizations, outsourcing your accounting needs—from bookkeeping to the CFO role—to a dedicated firm makes the most sense. Nonprofit accounting firms specialize in managing the finances of charitable organizations and can be more affordable than hiring a full-time accountant.

We strongly recommend working with the experts at a nonprofit accounting firm. Outsourcing your bookkeeping, accounting, and financial management needs enables you to better focus on your mission with these tasks taken off your team’s plate. Plus, when you work with a nonprofit-specific firm, you can rest assured that team members know the ins and outs of how to manage the finances of organizations just like yours.

Why YPTC Is the Right Choice for Your Nonprofit Accounting Needs

At YPTC, we’re passionate about helping nonprofits with their accounting needs. Working with our team of experts allows you to be confident in your organization’s financial management without taking time out of your staff’s busy schedule to implement the proper procedures.

Wondering why exactly you should work with YPTC? Check out the benefits our clients receive:

- Nonprofit expertise. What sets YPTC apart is our background in nonprofit-specific financial management. For three decades, we’ve worked with executive directors and board members across a variety of organizations to fulfill their missions more efficiently and effectively. Whether you run an association, foundation, museum, school, environmental organization, or anything in between, we have experience with similar nonprofits and can help you get your financial house in order.

- Flexible services. Our team adapts to your nonprofit’s needs to provide the perfect financial management solution for you. We can serve as your organization’s bookkeeper, accountant, controller, or Chief Financial Officer, depending on which services you’re looking for. From accounting and month-end close to financial reporting and data visualization, we offer a variety of services and can customize them to your nonprofit’s specific needs.

- Assistance from anywhere. We typically work with our clients onsite, allowing you to work with our experts face-to-face and ask them any questions you may have. However, we can also work with your organization remotely, leveraging your nonprofit’s preferred combination of video chat, phone calls, and emails. No matter the format, we provide that extra “personal touch” that makes our services stand out.

The YPTC team is ready and eager to help your nonprofit with its accounting needs so you can focus on your mission and beneficiaries. Don’t just take our word for it, though! Hear what some of our clients have to say about working with YPTC:

- “With YPTC, it’s never ‘your’ organization, it’s what ‘we’ need. That makes a difference when you’re a mission-driven nonprofit. YPTC isn’t an outside consultant as much as they are a team member.” – Allison Hay, Houston Habitat for Humanity Executive Director

- “For me, at the top of my ‘love list’ with YPTC is trust. That’s so important for me and our organization…Having a partner whom we can trust helps us focus on what’s most important for us – people who need help with food. We can focus on that because we trust YPTC wholeheartedly to ensure that we have accurate and appropriate reporting about how we’re managing our money. Because we have that trust we don’t have to worry.” – Kevin M. Yates, Founder and President of Meals in the Meantime

- “As a financial professional, I’ve dealt with a variety of consultants and accountants. To be quite honest, working with YPTC has been not just positive, but quite a pleasure. Their experience and recommendations have been useful in helping to shape us from a start-up into a more sustainable state. As a treasurer, I can say that relying on their professionalism and experience is invaluable.” – Carlos Orozco, Co-Founder of the Organization of Latino Actuaries

Additional Nonprofit Accounting Resources

From developing a budget to reconciling accounts to managing grants, nonprofit accounting encompasses a variety of activities that allow charitable organizations to successfully manage their finances. When you understand key accounting concepts, you can assess the financial health of your nonprofit and make operational adjustments as needed.

Outsourcing your nonprofit accounting needs enables you to focus on what’s important: your mission. Leave it to the experts to implement accounting best practices and keep track of your organization’s finances.

If you’d like to learn more about nonprofit finances, check out the following resources:

- Exploring Nonprofit Financial Management: The Ultimate Guide. Dive deeper into the ins and outs of nonprofit financial management in this guide.

- A Complete Guide to Demystifying Nonprofit Financial Statements. Learn more about each of the nonprofit financial statements and how to compile them.

- Nonprofit Budgeting: What Your Organization Needs to Know. Explore how to develop a well-rounded budget for your organization.

Jennifer Alleva

Jennifer Alleva is the Chief Executive Officer at Your Part-Time Controller, LLC (YPTC), a leading provider of nonprofit accounting services and #65 on Accounting Today’s list of Top 100 accounting firms. Jennifer brings over three decades of expertise in accounting and leadership to her role as CEO of YPTC.

When Jennifer joined YPTC in 2003, the firm consisted of just over 10 staff members. Since then, she has helped grow YPTC into one of the fastest-growing accounting firms in the country.

Jennifer’s accomplishments include her tenure as an adjunct professor at the University of Pennsylvania Fels Institute, her frequent speaking engagements on nonprofit financial management issues, her role as the founder of the Women in Nonprofit Leadership Conference in Philadelphia, and her launch of the Mission Business Podcast in 2021, which spotlights professionals and narratives from the nonprofit sector.