The new year can be a time of personal resolutions but also committing (or re-committing) to fiscal responsibility in our associations. If you are responsible for your organization’s finances – whether you are a CFO, controller, or a volunteer board member – you know that January is 1099 filing season. First on the list is timely filing 1099 forms to report income to non-employees, such as independent contractors. Your Part–Time Controller, LLC has a comprehensive 1099 Guide here, but below are some highlights as a refresher:

Who Should Get a 1099 and What is the Difference Between 1099-NEC and 1099-MISC?

There are many 1099 forms, but the most common forms are 1099-NEC and 1099-MISC. While they both help report income, they are used in different situations.

- The 1099-NEC is used specifically to report payments made to independent contractors or self-employed individuals for services. Independent contractors include temporary and part-time staff – such as Association Management Companies or freelance team members – and consultants and professional service providers (such as lawyers and accountants). It is easy to overlook paid trainers, speakers, or event coordinators, so make sure they’re not left off your list.

- The 1099-MISC is used for reporting payments for things like rent, royalties, prizes, or other payments that do not fall under non-employee compensation.

What Are the Thresholds?

The magic number here is cash payments of $600 or more made during the calendar year including payments made by check, electronic funds transfers, and bank wires. Payments made by credit cards, gift cards, or third-party networks such as PayPal or Venmo are excluded. Also, if your count reaches 10 forms or more (that is for any type of information return including 1099s and W-2s), be prepared to electronically file your returns. Luckily, there are many e-file solutions from which to choose.

Anything Else?

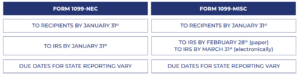

Timing matters. See the chart below for due dates:

E-file solutions often recommend cutoff dates before the IRS deadline, so map out a plan to be sure you can meet the filing deadlines.

In solving the 1099 puzzle, good record keeping and vendor communication are critical pieces of the puzzle. Collecting W-9s from all vendors prior to paying them will go a long way in ensuring a successful 1099 season. YPTC can help you compile W-9s, map your 1099 accounts within your accounting system, and process 1099 forms using an e-file solution. Visit yptc.com/hire-us and contact us for help!